The Growing Role Of Pay In Employee Experience and Business Performance

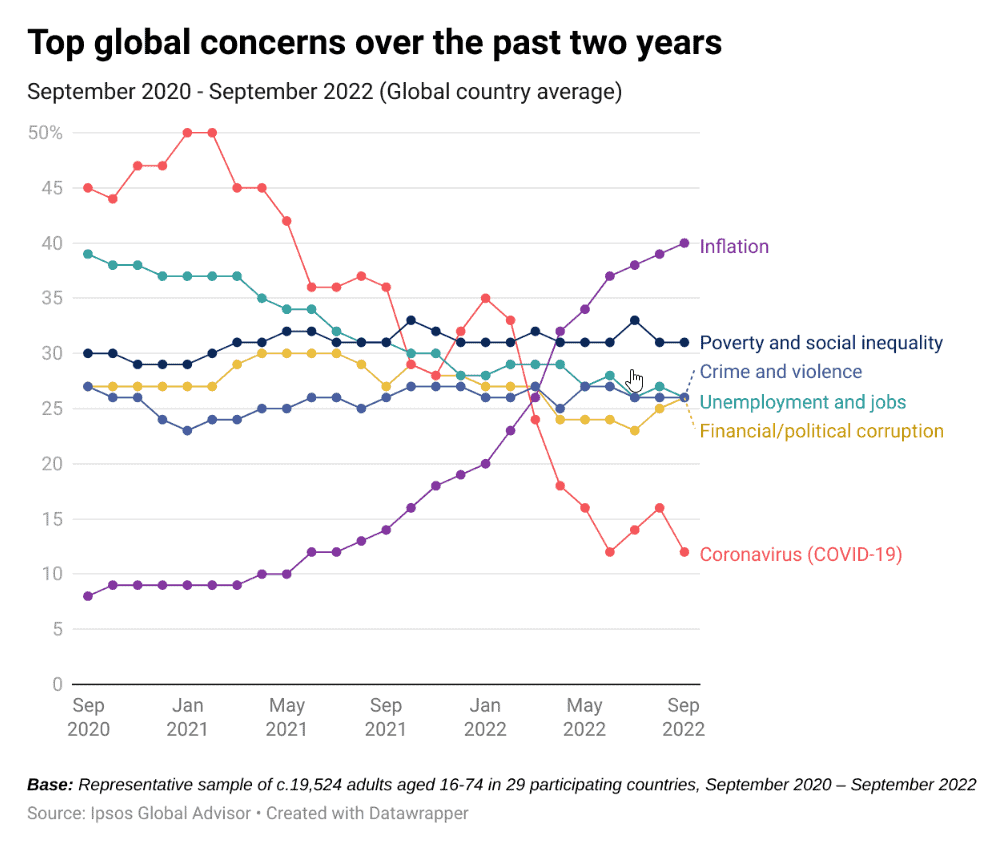

For the last three years we’ve been worried about burnout, mental health, and work life balance during the pandemic. This week a new issue has emerged. A new Mercer study of employee sentiment found that pay has suddenly become the number one factor in satisfaction at work.

When asked “what keeps workers up at night,” pay issues have risen to the top.

|

While opportunity to grow and a sense of belonging remain top drivers of engagement, among these 4500+ workers, pay now matters more. (And this is a global issue, as the research below points out.)

|

There’s no surprise why this is happening. The rate of inflation is extraordinary and everyone is tired of high prices. But for employers this trend has special meaning because pay practices are among the most legacy and old-fashioned practices of HR.

We studied pay practices many times and we’re in the middle of a new study right now. What we generally find is that most companies usse a traditional model that involves performance appraisal, stacked ranking or forced distribution, pay bands, and annual increases. Then most companies give employees bonuses based on profit or team performance. And that’s about it.

Today, however, this process is no longer enough. The research we’re going to be publishing shows that pay is now a C-level issue (coming in Q1). The philosophy should be supported by the CEO, it should be well communicated, it should be revisited regularly, and it must focus on equity above all.

In other words, “if I don’t understand why I’m paid as I am and how it is both fair and timely, I’m likely to be unhappy.” This means the compensation and benefits team, as well as the entire function of HR, has to be aligned on this new world of constantly changing pay.

Why the big change? There are two important drivers: inflation and pinpoint skills shortages. As we hire new people at a higher wages, all existing employees are affected. And more and more states now mandate that pay must be disclosed on job postings, so employees can see what others are being offered.

Pay Equity, which is the process of ensuring equal pay for equal work regardless of gender, ethnicity, or other demographic factor, is becoming a common practice. We explain the basics in our report on demystifying pay equity, along with lots more to come. Early next year we will publish an entire maturity model, framework, and lots of case studies and examples, plus a report on the role of technology and data.

As a good example, I suggest you read the most recent DEI report by Microsoft, which shows precisely why and how the company measures equity. I’d also suggest you talk with some of the experts in this space, including Trusaic, Syndio, Salary.com, and others.

As a good example, I suggest you read the most recent DEI report by Microsoft, which shows precisely why and how the company measures equity. I’d also suggest you talk with some of the experts in this space, including Trusaic, Syndio, Salary.com, and others.

Establishing The Right Levels Of Pay During Inflation

The second question that you’re most likely to ask is should pay go up? And if so by how much?

The most recent BLS data shows that wages are increasing at about 5% per year, which is not as high as inflation. But of course, inflation varies by location and mix of goods, so the 5% number is reasonably high based on historic practices. It’s often around 1.5-2% and occasionally over 3%. That leaves you with a question: do you increase wages at a 5% base pay before you add performance bonus? And then the philosophical question for the C-Suite: will we pay above average, below average, or in the middle?

The interesting answer that question is that when we surveyed thousands of companies and ask them about their pay, well over half say they pay above average, which of course is a ridiculous result. What that tells us is that companies believe they are offering above average rewards because they know how extensive and complex their various reward systems are.

And that is another part of the problem. The rewards space has become so complex, with insurance, benefits, wellbeing, flexible work, fertility leave, unlimited benefits, covid pay, that employers are wondering where it will stop. Non-cash benefits are increasing at around the same rate as pay (4.9%), and the BLS research shows that American companies now spend close to 33% of their payroll on this myriad of employee support programs. (This percentage has increased by 32% in ten years.)

As a result most CFOs are not thrilled about the idea of HR asking for even more money when they have been piling on benefits for the last three years. So what should you do?

Well, based on the research we’ve done and my own experience talking to many companies, you must understand that pay and benefits are not “compensation for work.” They are really part of the entire “deal” you offer to workers, making up a large part of your employment brand and employee experience. This means, as our research shows, that you need a C-level discussion about how and where you want to invest these dollars.

Remember that pay is what we call a “hygeine factor.” When it’s not high enough people will leave, but making it every higher has a rapidly diminishing return. Most employees come to work for much more than money: they want an opportunity to grow; they want a career; they want to work on projects that are exciting and interesting; they want the workplace to be safe; and they want to work with people they like and trust.

As my new book Irresistible points out, those factors are not common in every single company. The book explains that only 10 to 12% of companies in any industry are exceptionally good at managing people. So if you are an Irresistible company, you can get away with average or below average pay and still have a great workforce and a great employee experience. But you have to examine the Seven Secrets and think about how well you really understand them in your management.

That said, there are also companies that pride themselves on extraordinarily high levels of pay. I won’t mention names, but I know several of them and they tend to be competitive, aggressive, performance-oriented cultures, which is perfectly fine. I worked for several companies that operated at this level and I remember the feeling that every day was a race to keep up with the company, the business, and the rest of my peers. Early in my career I was very happy to do it and didn’t mind the pressure. But later in my career, as I became more focused on family and my own interests, I realized it wasn’t quite what I wanted. So I have moved to a career that’s much more focused on purpose and impact, and far less on pay.

At a broad level, this is what’s happening in the workforce. If you choose to run your company like an investment bank and pay people millions of dollars for hitting targets, you will attract a certain mercenary type of worker and these ambitious people get a lot of things done. They may not work well with their peers and they may leave if things don’t work out. But nevertheless, this strategy may make sense.

Generally speaking, however, when I look at the companies in our research, including those in the Irresistible book, companies that outperform over time tend to pay people fairly but do not pride themselves on always being the highest paid in their market. There are certain roles which demand high wages to compete: petroleum engineers, data scientists, cybersecurity specialists and others. But those highly paid roles equalize over time so you can adjust these positions for performance.

Generally speaking, however, when I look at the companies in our research, including those in the Irresistible book, companies that outperform over time tend to pay people fairly but do not pride themselves on always being the highest paid in their market. There are certain roles which demand high wages to compete: petroleum engineers, data scientists, cybersecurity specialists and others. But those highly paid roles equalize over time so you can adjust these positions for performance.

We’ve also seen that high levels of pay can sometimes create an entitlement. People get accustomed to these salaries and when times get tough they may leave. So again, you should make these decisions deliberately.

Communication is extremely important. People don’t always know why they’re paid as they are, and they will share their raises with others. The best companies take these issues head on: they communicate pay strategies clearly. They explain the pay strategy and describe why their “deal” is good for workers.

As an example, I just interviewed Dean Carter who recently retired as the CHRO of Patagonia. At Patagonia, a company who’s mission is centered around saving the earth, they created a very simple formula. Base pay increases are based on how well you increase your skills in the job itself. Bonuses are based on achievement of goals. This tells employees that “doing your job better” is valued just as much as “hitting financial targets.”

At Patagonia, if you’re getting better at your current job and your skills are improving, you’ll get a raise regardless of business results. Your performance bonus is based on your goals. This simple formula sends the message that hitting goals is valued, but not at the expense of learning to do your job better.

There’s many ways to use pay to drive your business strategy. A common direction is to pay people based on team performance: many companies now make 20 to 30% of the increase or bonus based on the performance of their team, not just their individual results. This creates teamwork and reduces the amount of individual competition. And there are many other ideas as well.

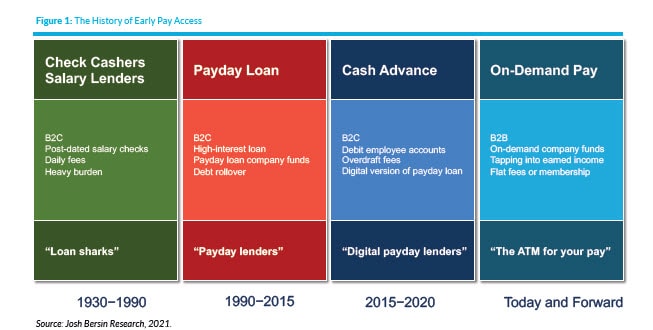

The final thing I’ll say about pay is you have to think about how it is administered. There are many new ways to deliver these benefits with impact. The Mercer research points out that many hourly workers see pay as a survival or lifestyle issue. Pay is eaten away by commute costs, student loan debt, credit card debt, and other financial overhangs. These employees bring these stresses into work: if an employee is worried about rent or buying groceries, they aren’t likely to be very productive. So there are many new options for the delivery of benefits that help.

For example, real time pay is a big trend: you can pay people at the end of the day for the hours they worked that day. This is a meaningful benefit for people on hourly wages, nurses and other shift workers. Another new option is pay designated to tuition reimbursement or student loan forgiveness. You can pay employees up to $5,250 per year for educational benefits and they will not have to pay tax. Many companies deploy that benefit for student loan repayment. Companies like SoFi have pioneered this and vendors like Guild and EdAssist offer entire career programs around these kinds of benefits.

|

The third area of benefit is known as financial wellbeing or financial wellness: teaching people to manage their credit cards better, put money into savings accounts, understand insurance, and build a 401k. There are many providers in this space and they can create life-changing solutions for your employees.

Pay Strategies Are A Dynamic, Strategic Tool For Business

Employee rewards and benefits, like everything else in HR, are a rapidly changing topic. The Compensation and Benefits leader, who used to negotiate with providers and run the annual process, now has to operate as a strategic consultant. Pay and its permutations are a vital part of the employee experience. They impacts your employment brand, retention, diversity and inclusion, and overall company strategy.

Remember this: we are all becoming service companies. While we account for pay as an expense, it’s really a big investment. By carefully investing in the right rewards strategy you are improving people’s lives, which in turn makes them more productive for you.

Additional Information

Irresistible: The Seven Secrets Of The World’s Most Enduring, Employee-Centric Companies

We Are Becoming A PowerSkills Economy

More Research on Pay and Rewards: Our Corporate Membership Program