TechWolf Accelerates Corporate Skills Tech Market With $43 Million Round

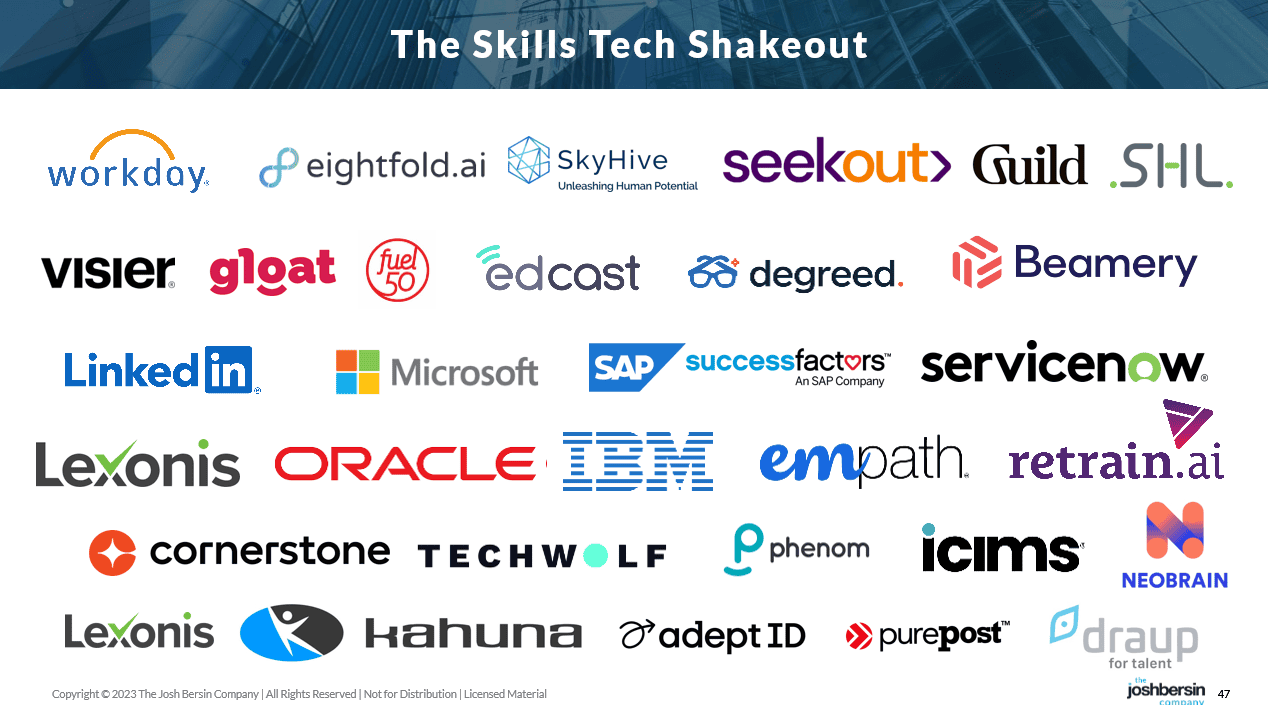

There is a frenzy of activity in the market for corporate skills technology. Microsoft, Workday, SAP, and dozens of specialized vendors (logos below) are building AI-based tools and platforms to bring skills data into every part of business operations.

The big vendors (Workday, SAP SuccessFactors, Oracle) have built “skills clouds” to help companies store their skills libraries in the core HCM system, while vendors like Microsoft (Viva Skills), ServiceNow (through the Hitch acquisition), Eightfold, Gloat, and Degreed have built purpose-specific skills technology to be used for recruiting, internal mobility, and what we call Enterprise Talent Intelligence.

To give you a sense of how competitive this market has become, a few weeks ago SkyHive, one of the pioneers, was acquired by Cornerstone, to add to the company’s EdCast LXP and other skills tools, rebranding the whole thing as Cornerstone Galaxy. In other words, the market is frothy, filled with vendors, and confusing.

|

In the middle of all this emerging maturity (the market is far from mature at this point), a few daunting challenges remain.

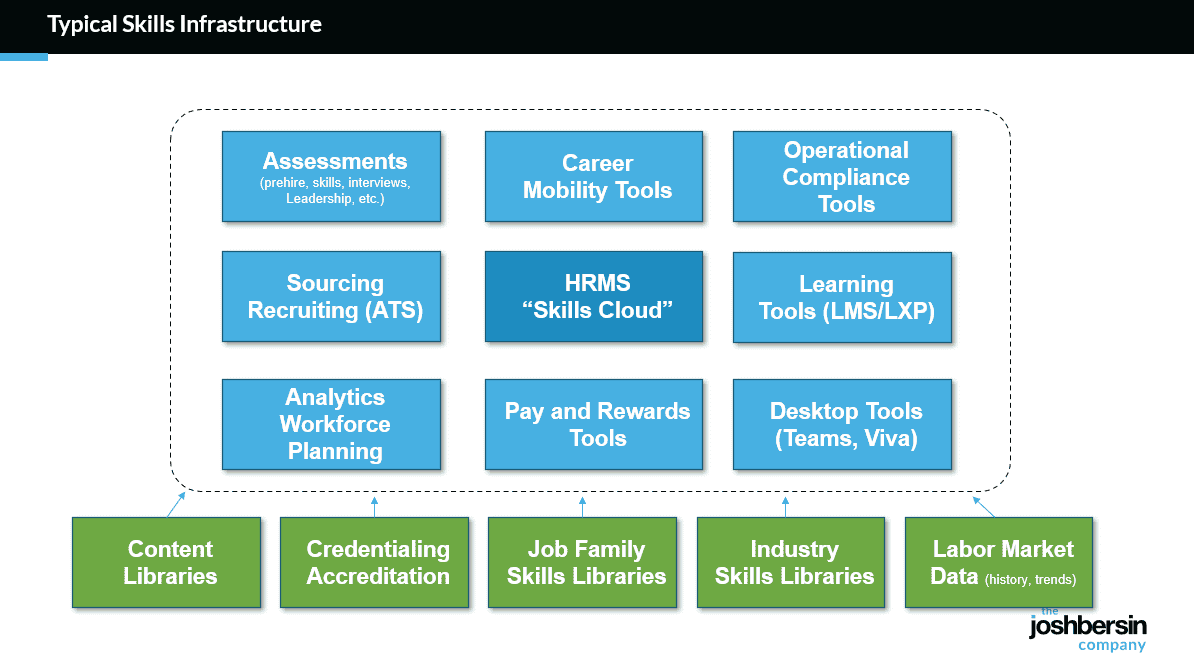

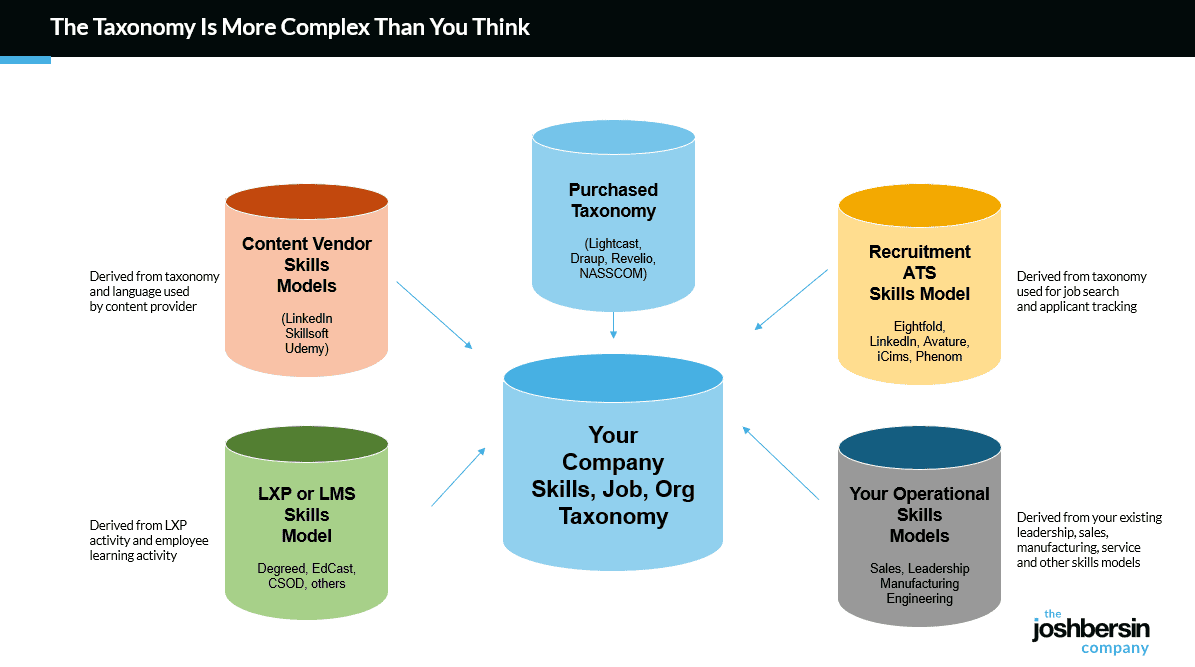

First, every company that wants to build a corporate skills strategy has to deal with many skills data providers (Draup, Revelio, GrowthSpace, Lightcast, the company that we use for our skills library in Galileo) and these data providers deliver business-critical data that companies need to stay up to date on new technologies, business processes, or job skills in the external market.

Second, companies that embark on this strategy find a myriad of internal skills systems to deal with. How do we incorporate our compliance systems? Our safety or production manufacturing systems? Our sales process? Every company has their own “internal skills” that make them special. How do the tools help us bring that data into the environment.

And third, we are always “inferring” or “assessing” skills internally by new methods. If you decide, for example, to open a new IT team to work on AI, you’ll be hard pressed to find a mature “skills taxonomy” for AI right now, so you’re probably going to build your own. And some of that will come from content companies, some will come from data vendors, and some will come from your own performance management process. Most of the SkillsTech vendors offer very little to help you build our own skills assessment and curation process.

Enter TechWolf. TechWolf, founded by a hard-working tech team (Andreas De Neve is one of the hardest working CEOs I’ve met), set out to build a middleware platform designed to address these issues. TechWolf, in some sense, is the “Switzerland” of skills technology, able to integrate skills data from most of the vendors in the market, infer and identify skills through AI-based analysis of your internal data, and a “skills studio” tool box to help you manage and curate this messy area of HR. (Note that both Workday and SAP have invested, essentially hedging their bets on this middleware AI space.)

|

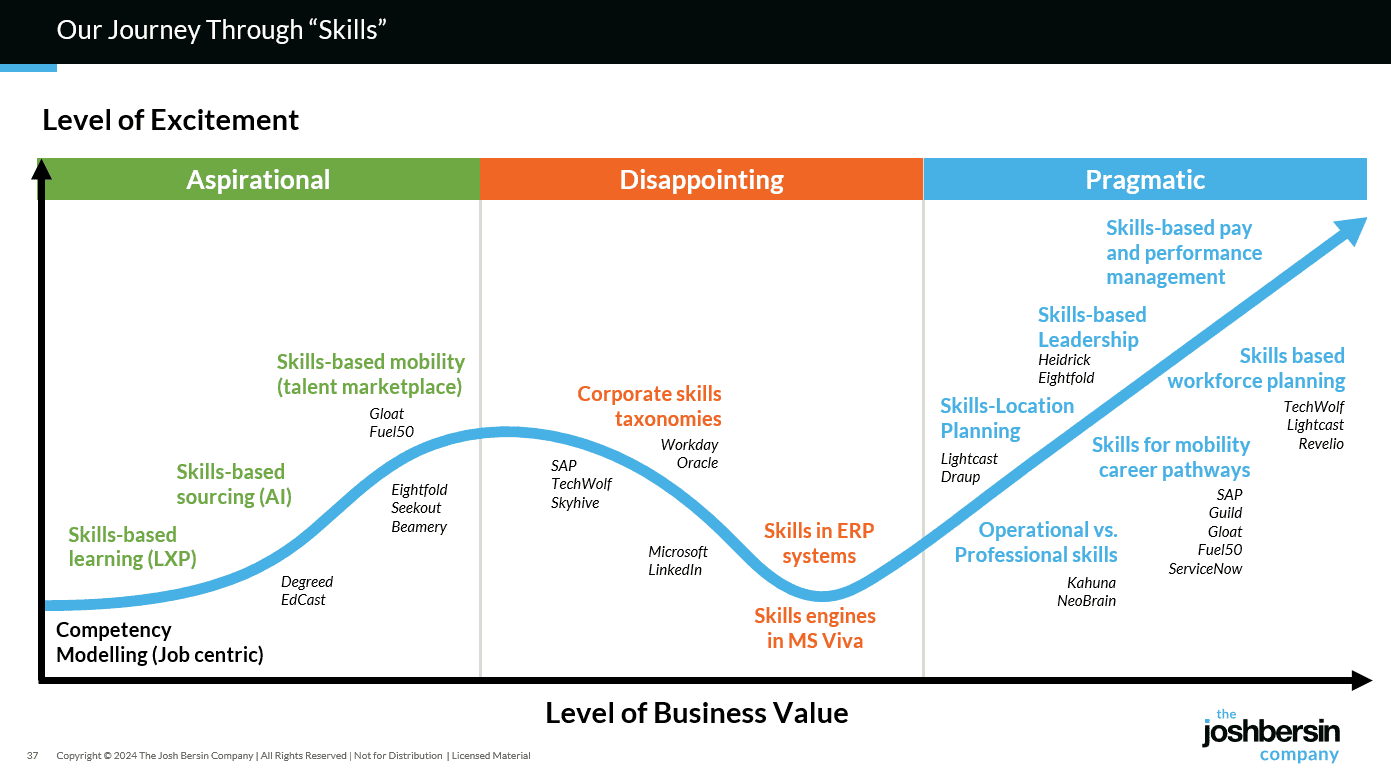

As I discuss in the “expectations” chart below, this space has reached a stage where big companies simply want a solution. A lot of the experimenting and “messing around” companies did has taught people lessons, so many buyers now realize that the “off the shelf” solutions from vendors like Workday are simply not enough. TechWolf, as a tech and data company in its core, is here to help you bring this together.

The way this works is as follows. You as a company buy a skills-based recruiting tool, a skills-based learning system, and a series of skills-based systems for assessment, compliance, and other operational needs (Microsoft Viva Skills will bring skills right into Office). While your ERP (Workday, Oracle, SAP) may tell you that all this can be stored centrally, in reality that doesn’t work yet. TechWolf comes along and shows you how their middleware system can integrate this data, give you the flexibility to add more, and make the curation and analysis of skills easy.

|

It’s a very compelling story and 30 large enterprises have already signed up (clients include United Airlines, MetLife, IQVIA, Synopsys, Workday, Booking.com, KLM, UCB, Ericsson, GSK, HSBC, bp, Virgin Media). We’ve interviewed many of TechWolf’s clients and they’re seeing tremendous value from the infrastructure.

TechWolf also promises more. In addition to inferring skills from employee profiles and matching with external data, TechWolf’s tools crawl internal data. So the system can look at employee documents, emails, and other data to figure out who seems to be expert at what. Other companies have tried this (most recently Yva.ai, which was acquired by Visier, and Glean, a hot AI startup) and they’ve been somewhat successful, but nobody has done it at scale. Techwolf is going to try to pull this off.

Despite the huge potential, this market is complex and difficult to navigate. Vendors like SkyHive failed to gain traction and many of the smaller players (including SHL) are struggling to find their spot. It’s not because they don’t have great solutions, but the problem itself is quite complex and I believe industry-specific solutions will ultimately be needed.

|

Right now, as the market slowly moves from “pioneer stage” to “early maturity,” it’s clear that TechWolf has a compelling story. Following companies like Mulesoft and Informatica, TechWolf could end up being the toolset that just brings all the heterogenous systems together.

We have worked with dozens of companies on these strategies, and I encourage you to read our Talent Intelligence Primer, our Enterprise Talent Intelligence Research, or our newest study Skills Strategy at Work (members) for more information.

My personal congratulations to Andreas and the team: it’s difficult to start an infrastructure company in such a noisy space: they are pulling it off and are adding major value to the market.

Additional Information

Enterprise Talent Intelligence Arrives, Disrupting The HR Tech Market

Building A Skills-Based Organization: The Exciting But Sober Reality

The Global Workforce Intelligence Project: Skills Gaps Industry by Industry