Banking Under Siege: The Secrets To Digital Success In Financial Services

The banking industry is hot again: interest rates are rising, people are spending money, and consumers want a more integrated, digital-first relationship with their provider. For consumer and commercial banks, however, the last decade has been traumatic. Everyone from Apple to Walmart to Google to Mastercard wants to take their business away. And new Buy Now Pay Later companies like Affirm and Afterpay have captured billions of dollars of potential loan business.

We just completed a major industry study of this market and discovered some important things. The bottom line is that highly transformed banks, which we call Trailblazers, have a vastly different strategy for IT and product management, operations, culture, and skills. And the Trailblazers, who we list in the report, are accelerating their lead from the rest.

We just completed a major industry study of this market and discovered some important things. The bottom line is that highly transformed banks, which we call Trailblazers, have a vastly different strategy for IT and product management, operations, culture, and skills. And the Trailblazers, who we list in the report, are accelerating their lead from the rest.

(The entire research collection is available to our Corporate Members.)

Here are the high level findings:

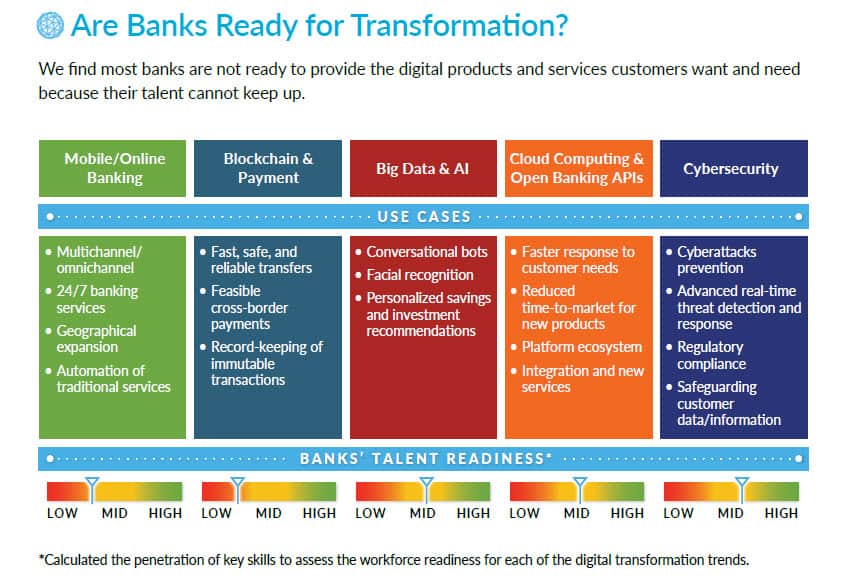

First, creating an integrated digital banking service is more complex than it seems. Banks have dozens of complex legacy transactional systems, each created years ago as a standalone set of applications. Today, as consumers want everything integrated in one digital experience, banks have to re-engineer these highly customized systems and build a new integrated data platform, a set of micro-services applications that replicate and extend these old systems, and a compelling user interface on top.

To put it mildly, this is not “typical IT department work.”

And that, essentially, is the problem.

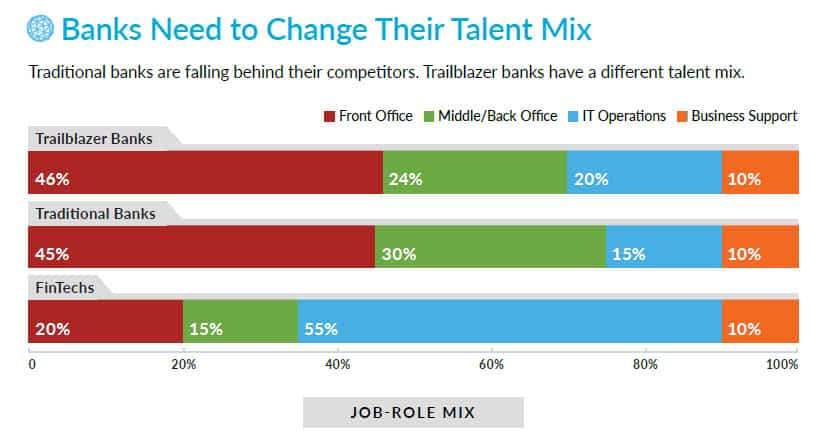

Our research examined the skills, talent, and organizational structures of more than 200 global banks, and we discovered something important. The “Trailblazer Banks,” those who are far ahead of their peers, have vastly different roles, job titles, skills, and distribution of labor than their peers.

For example, they have 30% more staff in IT and product roles and their technology skills are far different from most traditional banks. They look more like digital platform companies and much less like the “IT-driven service companies” of the past.

Second, they are very different in culture and management.

The Trailblazer banks invest heavily in skills development, agile work methodologies, design thinking, and iterative design. ING Bank runs their entire company around agile methodologies (explained in detail in my book Irresistible). DBS, the Digital Bank of Singapore, has real-time analysts monitoring web site traffic to see where consumers are going. And Trailblazers like CapitalOne have massive investments in AI to analyze data about their consumers and business customers.

|

Third, Trailblazer banks have a vastly different workforce composition.

Traditional banks have around 15% of their jobs in IT and 30% in middle/back office jobs. Trailblazers, by contrast, have more than 20% of their staff in IT (and product operations) and only 24% in the middle/back office. They have “productized” and automated many of the middle/back office roles. For a large bank, these variations are enormous.

|

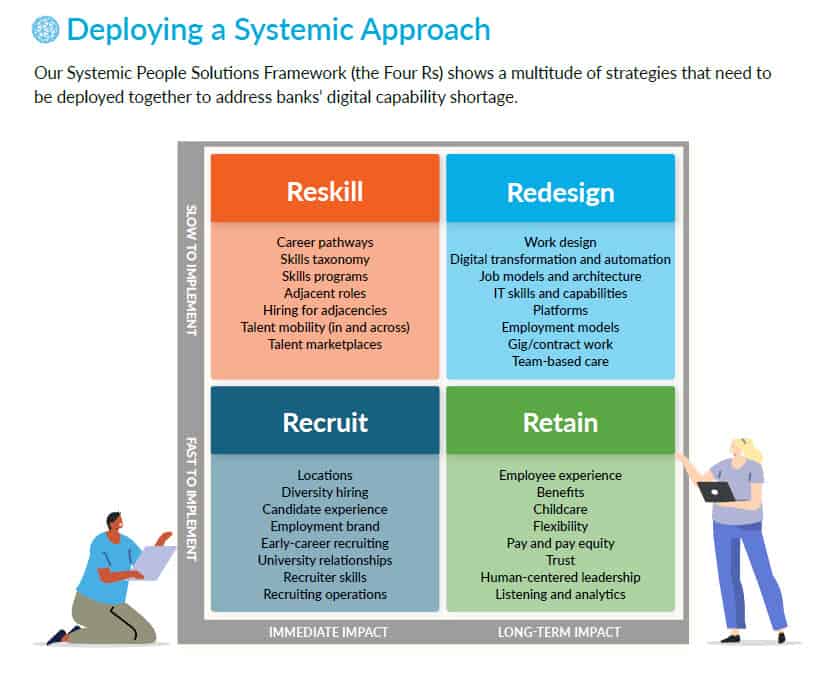

Fourth, Trailblazer banks have a much more strategic focus on skills.

Not only do companies like Rabobank and ING have digital skills academies, they invest in internal mobility, career development, rotational assignments, and Capability Networks. BNY Mellon, for example, set up a series of Capability Networks to advance their skills in project management, product management, and data analytics across the entire bank. Capital One developed their own Cloud Academy, enlisting support from many BigTech companies for education and advice.

This industry, like many of the others we are studying in the GWI Project, is going through its digital transformation at an uneven rate. As we analyzed these companies we found that the Trailblazers are not only more profitable and financially successful, they are accelerating their lead. Why? They have become “talent magnets.” Highly skilled technical, design, and engineering professionals do not want to work at “old school” banks – they quickly leave. This makes the better banks even better.

One of the keys here is the 4-R model we use with our clients. Fast-transforming organizations can implement these four R’s in an integrated way. They also have much deeper skills in change, business transformation, and organization design – disciplines that define the future of every HR and senior leader in every industry.

|

How Can You Learn More?

This research, conducted by Stella Ioannidou, includes in-depth benchmarking guides, case studies, and a comprehensive analysis designed for CHROs and CEOs. It essentially lays out the next step in your organization’s transformation journey.

If you’d like more information, please contact us or download our GWI Banking Infographic. If you join our corporate membership program we will walk you through the findings and you can benchmark your company against the Trailblazers.

For more information on the Global Workforce Intelligence Program, download our whitepaper on the changing world of industries, jobs, and organizations. We look forward to hearing from you.