Update From The Workday Innovation Summit: Lots Of Growth Ahead.

I just finished a day with the Workday executive team at their analyst Innovation Summit (entitled “The Power To Adapt”). Let me share my perspectives.

Workday’s Growth Will Continue

Despite the pandemic and lots of changes in the tech landscape, the company is doing very well. With a 22% subscription growth rate and nearly $5 Billion in annual revenue, Aneel Bhusri believes Workday will hit $10 Billion in revenue within the next four years. Why the continued optimism? The company sees strong win rates and believes there is not that much competition. Today more than half the Fortune 500 use Workday for HCM and the company is aggressively growing its international business and financial applications (more than 1,300 customers). So yes, life is good at Workday.

(Note: IDC now rates Workday as the #1 HCM provider with around 13% market share, 30% higher than SAP which is #2.)

Here are the numbers (as of January 2022).

- All Workday customers: 9,500+

- Workday Financial Management: 1,300+

- Workday Human Capital Management: 4,050+

- Workday Adaptive Planning: 5,900+

- Workday Learning: 1,975+

- Workday Payroll: 2,625+

- Workday People Analytics: 500+

- Workday Prism Analytics: 925+

- Workday Procurement: 1,100+

- Workday Recruiting: 3,100+

- Workday Strategic Sourcing: 400

- Workday Time Tracking: 2,775+.

Why is Workday continuing to grow? In addition to its strong management team and focused sales and marketing, the architecture and product line continues to evolve.

Evolving The Workday Architecture

The big innovation Workday brought to ERP was its cloud-ready architecture. Workday famously has its own object-data model built on a graph structure database, enterprise business process framework, and novel user experience. This architecture let Workday compete successfully against Oracle, SAP, Infor and many other HCM and ERP vendors and eventually won over the hearts and minds of HR and IT executives around the world.

Since then, however, the IT world has changed. Companies use multiple public clouds (Azure, Google Cloud Platform, AWS), they buy many specialized cloud applications, and they now use tools like OKTA, Microsoft Teams, and ServiceNow for identity management, productivity, and employee experience. So Workday, which was designed to be the “Power of 1,” can no longer define itself as an end-to-end experience. In fact many large companies “hide” Workday behind these other systems, delegating it the role of “core system of record” and primary ERP system for many applications.

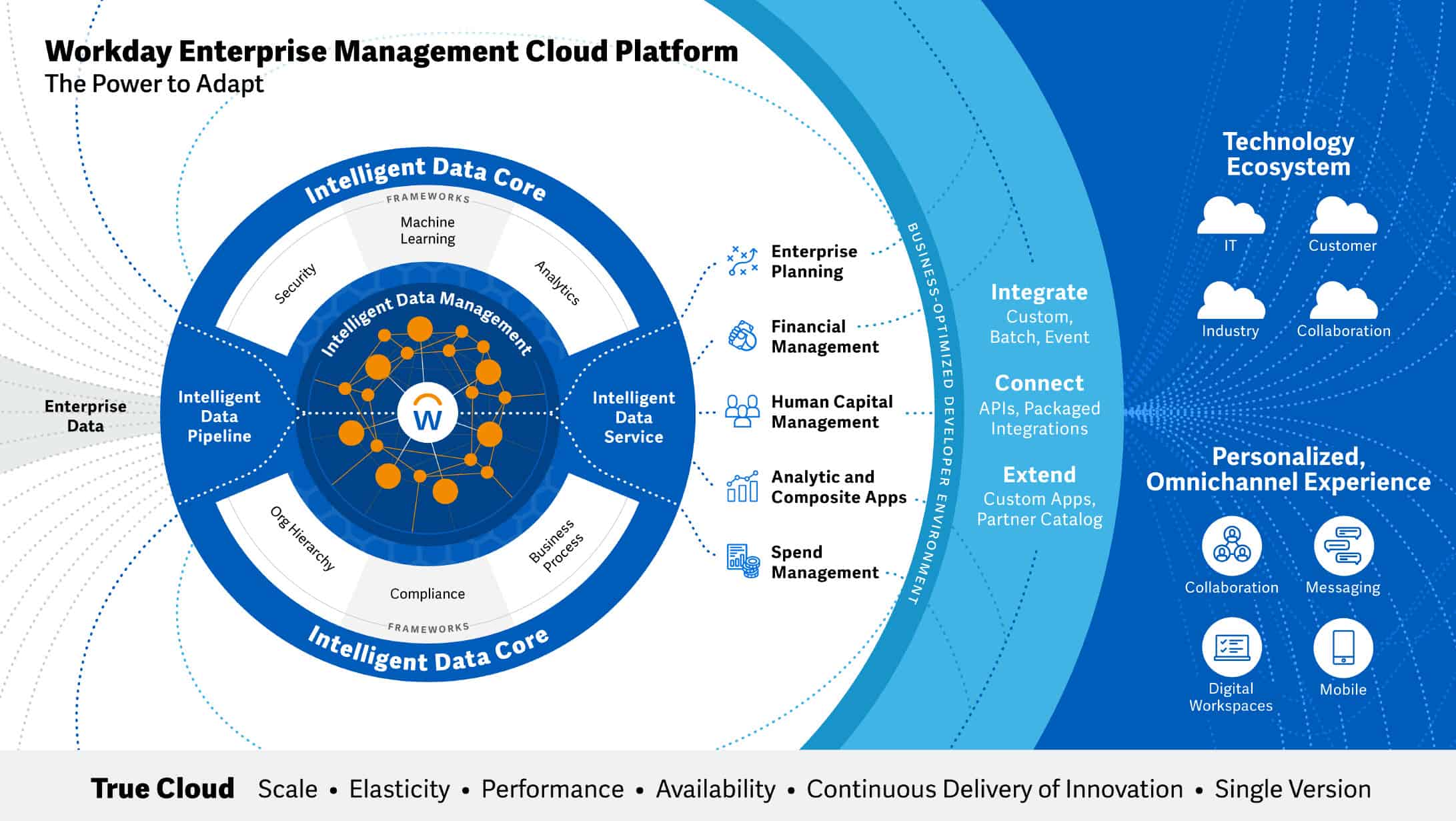

The Workday platform has evolved. As a team of senior technology architects, the Workday product executives have extended the architecture to a new domain. Pete Schlampp, the Chief Strategy Officer, described it as an “enterprise management cloud,” a set of integrated applications, operating under a single business process and security framework, that delivers best of breed and partner applications to the HR, finance, planning, and business leader.

|

I know that sounds like marketing, but there really is something here. Over the last few years, Workday has opened up its proprietary architecture and now offers a platform called Workday Extend (APIs and development tools) and Workday Orchestrate (an open toolset for workflow design) to let customers extend Workday and build new applications.

The result is what Pete Schlampp calls an enterprise “mesh.” In other words, customers can buy new Workday modules or applications and they all use the same security, business rules, user interface, and identity management as the core system.

As far as the Employee Experience (Oracle just announced Oracle ME, a whole product designed to compete with ServiceNow), the company has its act together. Not only is the Workday Employee Experience now becoming very personalized and easy to use, Workday is committed to chat and transactional integrations with Microsoft Teams, Viva Connections, Slack, and other systems. So the original Workday UI is rapidly being updated.

In fact, as the team discussed its partner apps, it felt like they were almost more excited about these than they were about their own. (Not quite of course, but this is a big deal.) Just like Apple and Microsoft have “app stores” which create business models for thousands of creators to build solutions, Workday is doing the same. And this gets into the topic of Workday’s acquisitions.

Workday’s Acquisition Strategy

In the early days, Workday proudly positioned its “integrated and single vendor” solution, pointing out that competitors like SAP or Oracle were “Frankenstein” architectures (bolted together with fragile and poorly integrated interfaces). Since then, however, Workday learned that it, too, had to acquire good technology to grow.

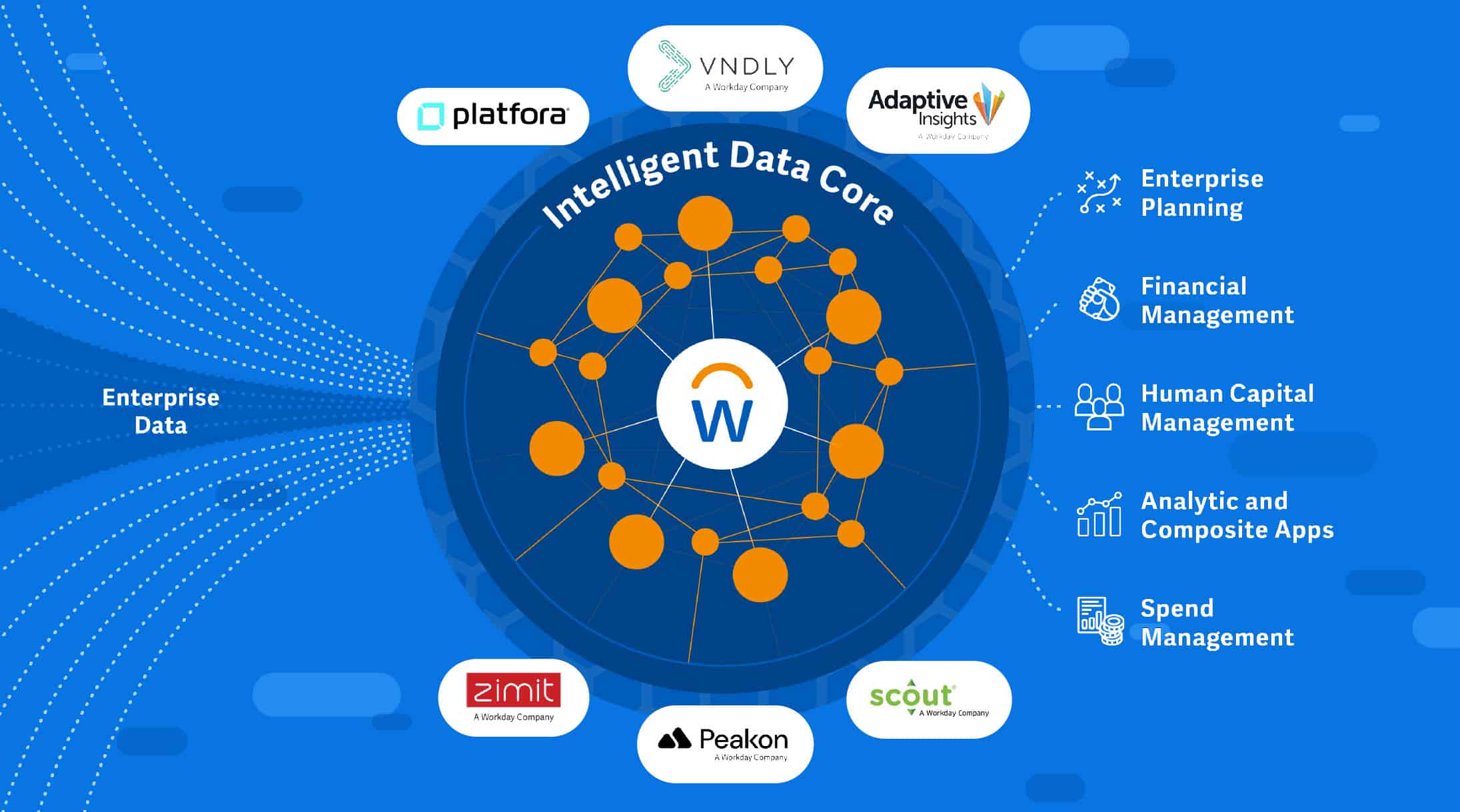

The first few acquisitions (Cape Clear, Identified, Mediacore, and others) were technology deals, designed to help Workday build out its core platform. Later Workday acquired Platfora (where Pete Schlampp came from) to greatly extend its data services and then application companies like Adaptive Insights, Peakon, VNDLY, and Zimit. These later acquisitions are real applications which had lots of customers, so Workday had to find a way to integrate them.

As Sayan Chakraborty, head of technology, discussed, this means Workday needed a new model. Realizing that these apps have their own data structures, application logic, user experiences, and security schemes, Workday now “blends” these apps into the Workday object model and business process framework, giving customers access to the new application without losing any of the security, identity management, and system of record profiles they have in place. It’s an architected and “tightly coupled” integration, so these new systems (and development teams) can grow and thrive as “Workday properties.” (Sayan’s words.)

|

Given the fact that most of these vendors are already cloud-enabled, Workday then gives them access to Workday AI and ML teams, the Workday Kubernetes tools, and Workday’s cloud platform APIs. So these add-on acquisitions can thrive and grow while focusing on their unique value-add.

Industry Focus

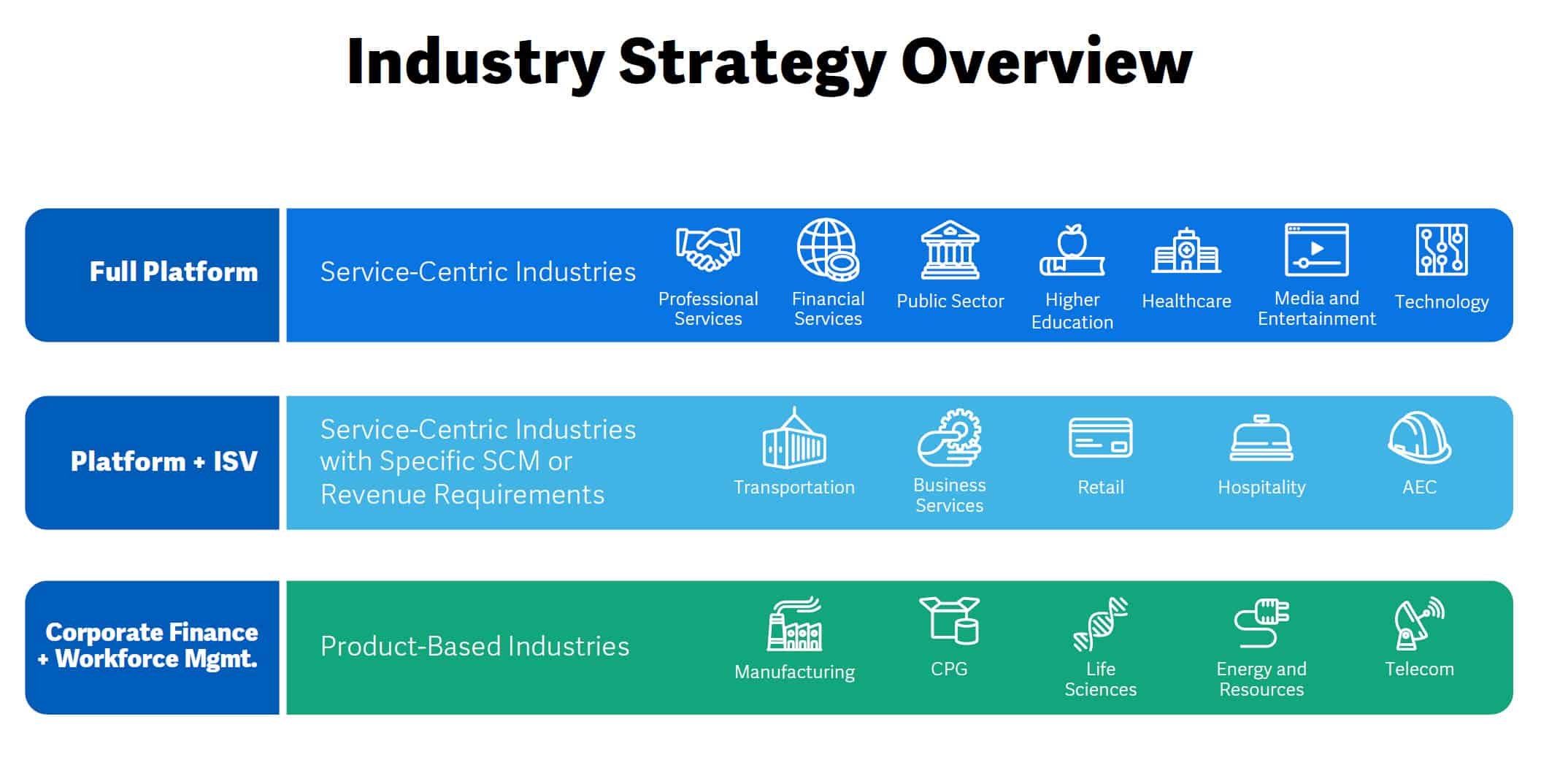

The new architecture has many other implications. Workday understands that its product has to be more verticalized over time. While most ERP companies would like to sell one package to every company, industries like healthcare, retail, and manufacturing are very different from people-centric businesses like banking, finance, and professional services (where Workday has been very successful).

To address this, Workday is expanding its industry focus. Through the use of partner apps, the company plans to extend its HR, Finance, and Planning apps into these other industries. And consulting firms like Accenture, Deloitte, and others will help. For example, there are now partner apps that help manage the cost of contingent labor in nursing, create back to work programs for retailers, and other “vertical” industry solutions.

|

A Deep And Well Aligned Management Team

What does all this mean? To me this shows that Workday’s $10 Billion revenue target is very achievable. Let me add a few other points.

First, we know that HCM selection and implementation is a very complex process, and Workday is not the right fit for everyone. Some mid-sized companies in certain industries (healthcare, energy, manufacturing, retail) are often better served by specialized vendors and sometimes Workday is too expensive for a client. Now, however, as the architecture becomes more open, the company can win more of this business.

Second, the company is laser-focused on employee experience. While every component in Workday may not be best-of-breed, right now the EX platform is getting a lot of attention. The company is very proud of its Peakon acquisition (Peakon was a best-of-breed employee listening and performance enablement solution) and is extending its toolset to make the platform useful in the flow of work. You can use Workday from Microsoft Teams, Slack, Viva Connections, and Google Chrome. Lots of features (chat interface, cards, messaging) are making the platform more open, turning the system into an “action platform.”

Third, by clearly articulating its strategy to attract developers and open up the architecture to whole new applications, Workday no longer looks like an elegant walled garden. It is becoming a welcoming garden with lots of small “properties” to visit.

Finally, I have always been impressed by the alignment and level of coordination across Workday executives. The product, technology, and leadership team remain very focused on the company’s culture, ESG footprint, and the need to stay open and vigilant in a world of rapid technology change.

Overall this was a very inspiring meeting, and I see nothing but goodness for Workday ahead.

Additional Resources

HR Technology Market Disrupted: Employee Experience Is The New Core