People Data For Sale: How The Talent Intelligence Market Really Works

Have you ever wondered where all your personal and professional data goes? Here’s a peek into the multi-billion dollar “people data” market.

One of the most dynamic and important parts of our economy is the marketplace for people data. Every recruiter, location planner, HR executive, economist, university head, and government planner wants to know where jobs are growing, what skills are in demand, how salaries are changing, and much more.

While much of the announced BLS data comes from surveys, there is a far more sophisticated, AI-powered industry behind the surface: the “people data” market.

The Structure of the People Data Market

For decades companies like Monster.com, LinkedIn, and hundreds of others scraped (algorithmically copied) all sorts of data about people, job postings, and company information. Most of them did this to build products and services, but now the business is so massive that “data collection itself” is a big business.

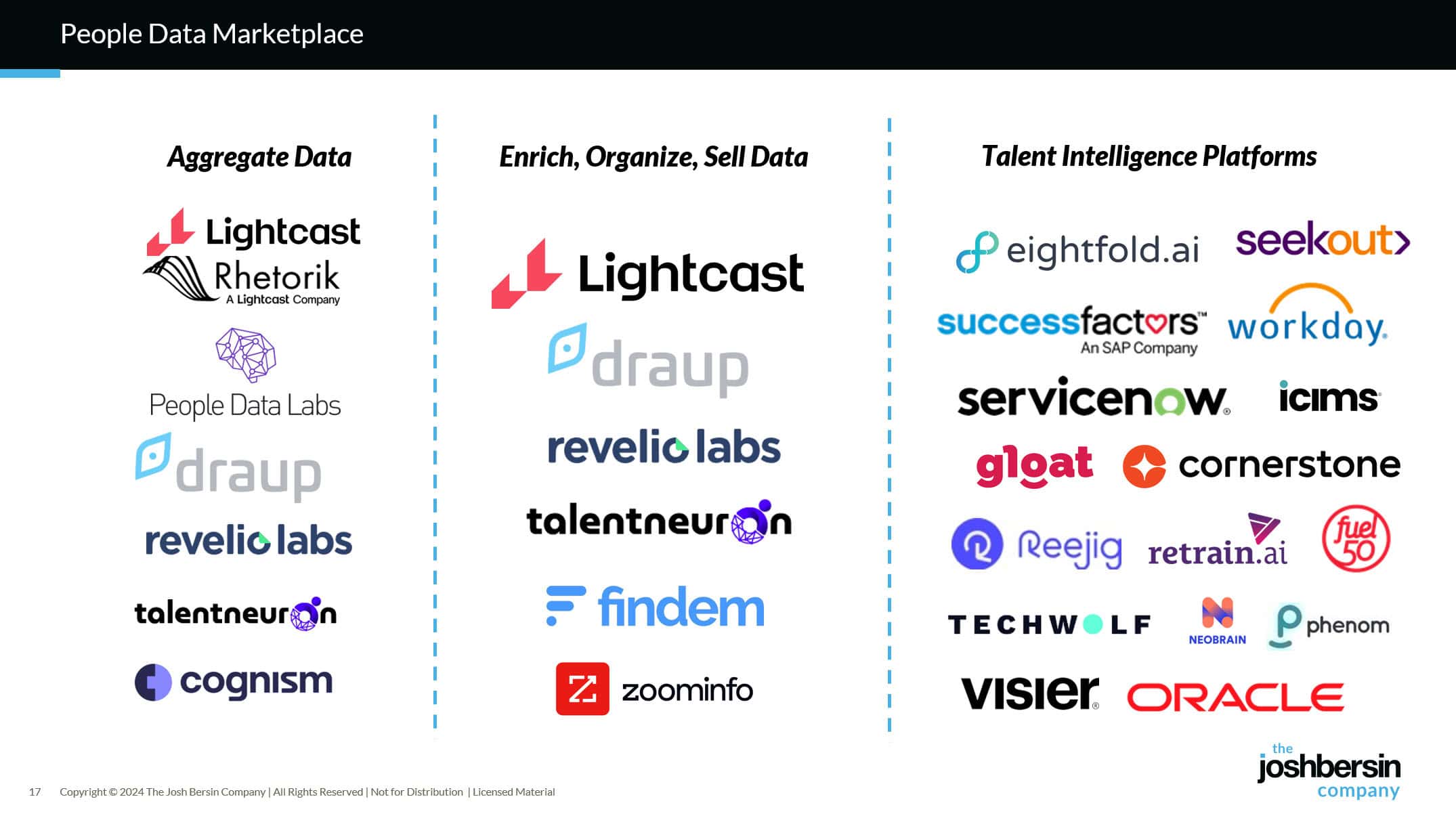

Roughly speaking, there are three categories of vendors, and many of these overlap.

Category 1: Data Aggregators include companies like like Rhetorik (just acquired by Lightcast), Lightcast (job market data), People Data Labs (PDL), SignalHire, Revelio Labs, Cognism, Coresignal, Draup, and Talent Neuron.

These and others specialize in amassing detailed professional profiles. They source data from a mix of public records, web scraping (including public LinkedIn profiles), and partnerships with smaller data vendors, many of which operate globally and sometimes in less visible ways (ie. Israeli spy companies).

Some of these aggregators sell products (Revelio, Draup, Talent Neuron, Lightcast) directly, but in a sense this puts them into the second category: data enrichment and organizers.

Category 2: Data Enrichment and Organizers take this information and build taxonomies, skills models, job titles, and standardized data elements so it can give us insights. Much of their value is making sense of the network of data, often through inference, daily updates, and integration with well known frameworks.

These companies, which include Lightcast (the leader in people and workforce data), Draup, Revelio labs, TalentNeuron, Findem, Zoominfo, and many others focused on sales and financial services, are data science businesses. They take millions of records arriving every day, organize and clean them into taxonomies (ie. Job models, occupational codes), build skills inference, and correlate data about a person to their employer(s), location, education, salary, and other information.

They then package the data into connectors or APIs so the third level of vendors can integrate it into their applications.

The data science is complex. People and job data is a “connected chain” of information that starts with a person, then goes to their education and skills (inferred), job history, employers, and locations. This tree of data is connected to company data (the company’s history, investments, and products and services), which is connected to locations, technologies, and projects.

When done well, a data enrichment company can tell you things like “what job titles are increasing in value” or “how are AI engineers skills fragmenting into sub roles” or “what are the trending skills and experiences needed for EV engineers” or “what are the new energy sciences being invented, which companies are using them, and how do I find people in those domains to hire.”

In other words, if you use this data well you can outpace your competition in rather astounding ways. We talk with companies who use Lightcast for location analysis, for example, making hundred-million dollar decisions on location strategy for their companies.

Category 3: Talent Intelligence products and platforms are the third part of the chain.

These companies, which include almost every vendor in HR (shown below), take this data and put it into your systems for recruiting, skills analysis, planning, development, internal mobility, and much more. They “leverage” this data and match it with your company data (which is often quite limited) to “enrich” your internal HR systems so they’re very very smart.

Imagine if you wanted to find the best marketing mind or engineering staff for a certain project. Most likely your HRMS has very little information other than current job and maybe college degree. The data within the talent intelligence platform, leveraging data from category 1 and 2 before, can tell you who the perfect fit may be. And now that AI is so powerful, you could even look for leadership candidates and people ready for promotion.

Here is a rough, slightly limited, view.

|

What Are The High-Value Applications?

The people data market serves four primary end-user segments:

• Enterprise (Corporate): For workforce planning, talent acquisition, and skills strategy.

• Education: To assess student outcomes, design curricula aligned with labor market needs, reach out to students, and report on economic impact .

• Government: For economic development, policy design, and workforce investment.

• Sales and Marketing: For lead generation, market segmentation, and customer targeting.

In our case (Enterprise), this data is essential for growth and performance. As we implement more and more AI systems, we need better and better data to “inform” the AI.

Consider Galileo, for example, which has direct access to the Lightcast data set. You could load the names, job titles, and most recent bios and discussion recordings of your ten employees and then ask Galileo to evaluate, compare, and benchmark these individuals against the skills in their job titles. That simple use-case alone could help with coaching, performance management, development, hiring, and job design.

I recently asked Galileo to go back and analyze my last six months of internal meetings, giving me a list of our employees. It assessed each person’s top skills and strengths (matching against Lightcast and other sources) and showed me the strengths and weaknesses in our very company! And while much of what it told me I already knew, it actually pointed out some things I had missed.

This is only a tiny fraction of the types of things we can do. Imagine using this data set with AI to evaluate job candidates, source candidates, and even compare salaries against external market trend in employee locations. All this becomes a simple conversational process with an AI system like Seekout, Galileo, Eightfold, or others.

Latest News: Why Did Lightcast Acquire Rhetorik?

Let’s get to Lightcast. Lightcast, one of the largest players, acquired one of the data collection firms, Rhetorik. This gives the company a deep source of worker profile data and also helps Lightcast expand its current business into new segments like sales data, marketing data, and other markets.

Today Lightcast sells into three markets: corporate (and vendors), educational institutions, and government. Not only will Rhetorik’s data help expand the richness of worker and employment data in each, it lets Lightcast enter the market for sales and marketing data (which is as big as the market for employee, employer, and jobs data.)

Remember that as Lightcast’s “worker profile” data gets richer, the company can hone and improve its data on skills, salary benchmarks, career mobility, and career transition. So with the data science team already in place, Lightcast sees a multiplying effect across all its market segments.

AI Makes This Market Accelerate

As I discuss in this week’s podcast, AI tools (Galileo, MS Copilot, others) give every manager or HR professional the power to leverage and learn from people data. No longer do you have to design reports, run queries, and search for taxonomies.

Today, with tools like Galileo and others, you can simply ask a question and the “talent intelligence” system gives you important answers. Lightcast, fully aware of these massively growing markets, is focused on staying in the lead.

Additional Information

The Talent Intelligence Factbook

Learn about Talent Intelligence with Galileo Learn

The Skills-Based Organization, Is It Real?