Cornerstone Galaxy: Acquisition Of SkyHive Could Pay Off

Cornerstone spent the last decade acquiring LMS and talent software companies, all in a goal to build an integrated skills platform. Finally, after years of hard work and integration, the company introduces Galaxy, an advanced offering in the world of AI-powered HR systems.

Before I explain Galaxy, the history is important. Founded in 1999, Cornerstone started as an e-learning platform company (CyberU). The company established a foothold in the emerging LMS market and grew through strong marketing, sales, and product innovation. Since then the company has gone public, reached a $5.2 billion valuation, and was then acquired by a private equity firm (Aug. 2021, three years ago).

The new management team continued to acquire companies (EdCast, SumTotal, Talespin, and most recently SkyHive) and has now stitched these systems together into a unified platform called Galaxy. Galaxy, as I show below, is a skills-powered integrated talent management platform, built around the core of learning management. And this is what makes it unique.

The other talent intelligence or skills-based platforms started elsewhere. Eightfold started in talent acquisition; Gloat started in talent mobility; SeekOut started in recruiting; Beamery started in CRM; and players like Retrain.ai and NeoBrain started in more vertical domains. Each of these companies use large-scale profile data to infer skills, give companies tools to find and match candidates, and eventually to deliver learning.

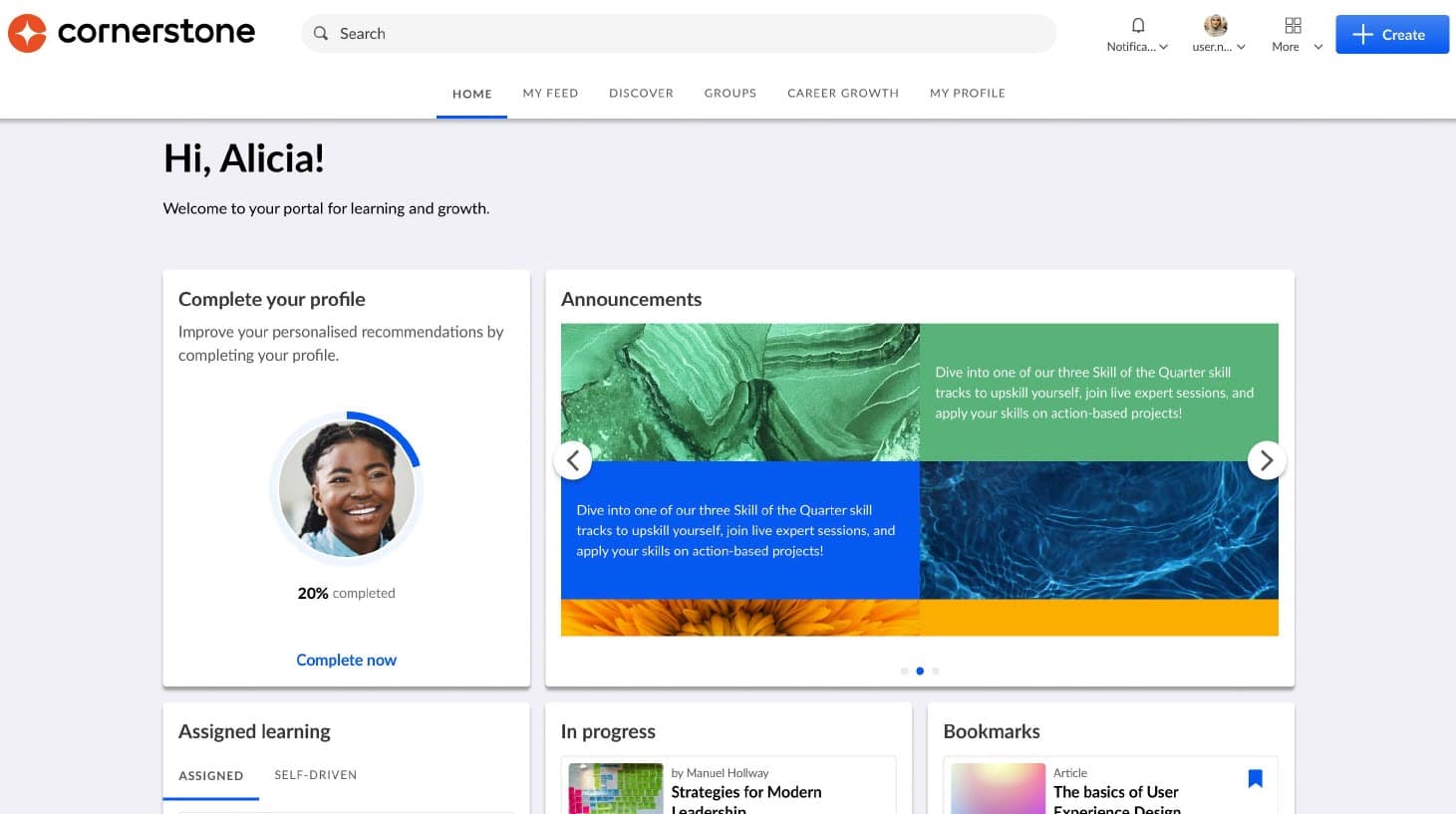

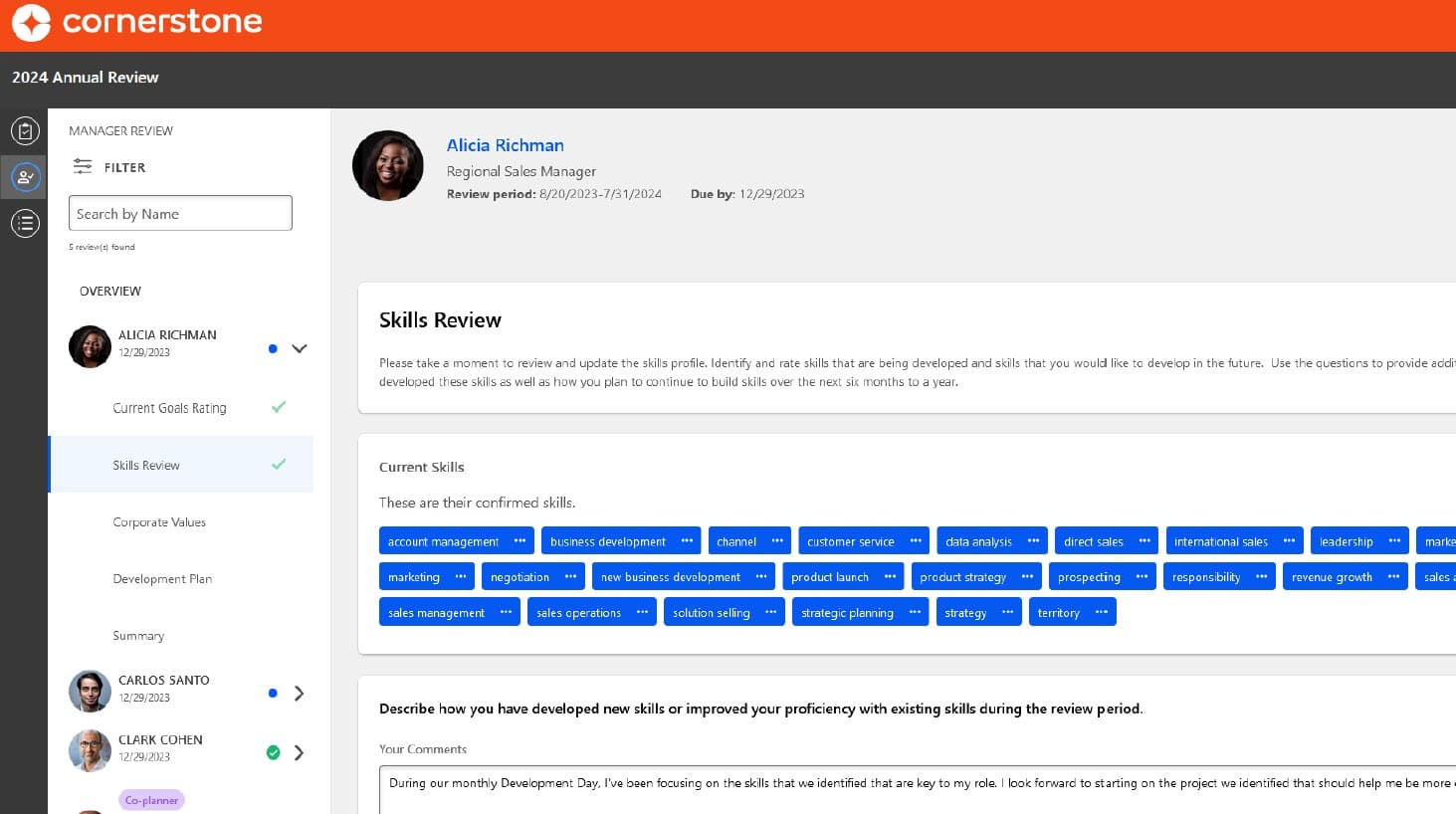

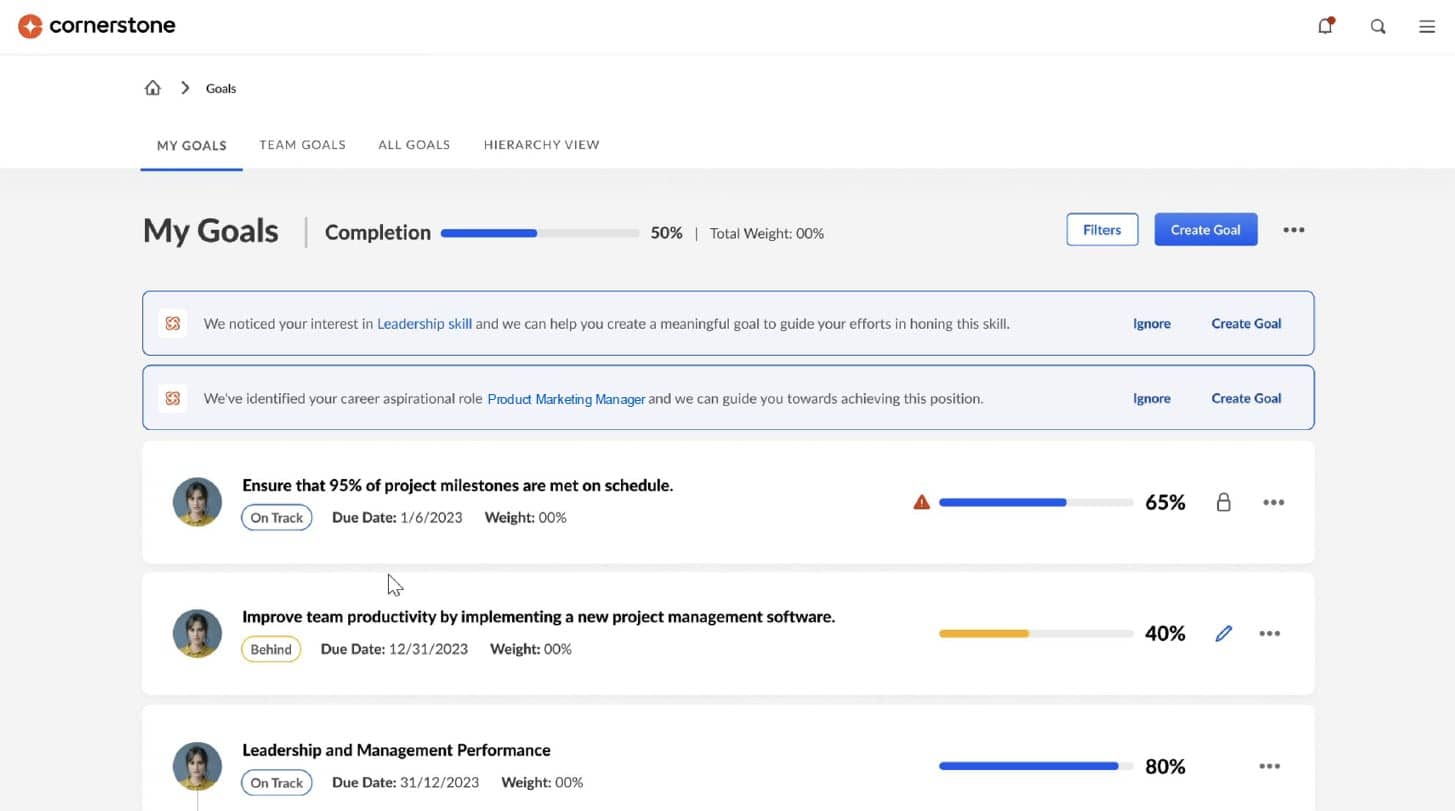

Cornerstone, with deep background in L&D, is coming at this from another direction: employee development. The Galaxy system, which is built into a complete user interface, infers skills, lets employees tag and assess their skills, helps employees find and complete many forms of learning, manage compliance and certification programs, and advance skills through gigs, assignments, assessments, or management coaching. And since Cornerstone is an integrated talent suite, the system lets companies drive skills through performance management, development planning, succession planning, and also recruiting.

Before the acquisition of SkyHive, Cornerstone was trying to do this with its own data set of LMS information. This data, which includes billions of learning records, was simply not sufficient to build out the entire AI corpus. By acquiring SkyHive, Cornerstone gained an entire labor market system of data, a company-neutral job architecture, and lots of industry skills. This brings Galaxy into direct competition with the other major talent intelligence and talent marketplace vendors.

I have not yet talked with Galaxy customers, but the user experience is integrated and shows the sophistication of thinking under the covers. Remember that Cornerstone acquired Evolv, Clustree, and EdCast before acquiring SkyHive, so the team has been building AI capabilities and use-cases for several years. And now that Cornerstone has a VR platform for learning, more use-cases are coming.

While I don’t know Cornerstone’s revenues, the leadership team assures me that the company is growing and the profitability is high. This means the company has long-term sustainability and despite its many acquisitions, is likely to evolve to “Oracle-like” status. (Oracle has acquired hundreds of companies over the years and now looks at M&A as one of its core strengths).

Here’s the major play in the market. With 7,000+ customers, Cornerstone has many customers shopping for new tools. If Galaxy is as solid as it looked in the demos, some percentage of these buyers could upgrade to Galaxy and avoid the purchase of Gloat, Eightfold, or another LMS. While we cannot be sure where Galaxy will play, for companies that want to deploy a skills architecture across all talent practices, it looks like a solid option.

Cornerstone Vision:

|

Cornerstone User Experience

|

Cornerstone Career and Talent Marketplace

|

Cornerstone Performance Management

|

Skills in Goal Management

|

Why Cornerstone Still Matters

Cornerstone has a massive customer base. The users of Cornerstone, Saba, SumTotal, Lumesse, and Halogen include many of the world’s largest companies and thousands of mid-market organizations as well. These organizations have invested billions of dollars into learning infrastructure, content, and user portals to reach employees. If Cornerstone Galaxy delivers on its promise, the company can help many of these organizations avoid buying lots of standalone new tools. And given Cornerstone’s size, the company could become, as I mentioned above, the “Oracle” of the space.

And note, by the way, that a recent survey by HR.com found that the top rated HR tech issue to address is L&D infrastructure, so this issue is on everyone’s mind.

While the market is highly competitive and there are many skills-based tools in the market, Cornerstone’s focus on L&D is unique. None of the other major LMS vendors have the skills infrastructure of Cornerstone today.

If your skills strategy is focused on building skills, Galaxy may be the answer.

More to come as we talk with more Galaxy customers.

Additional Information

Introducing The HR Career Navigator

Why Is It So Hard To Be A Chief HR Officer (CHRO)?

Research Shows That High Growth Large Companies Have Distinct HR Skills

Career Pathways: An Innovation That Could Transform The Economy