Cornerstone Xplor Launches A New Era In Corporate Learning

This week Cornerstone, the largest provider of corporate learning technology (and LMS), launched a new product that is likely to change the market. Cornerstone Xplor, a new skills-based, AI-powered platform designed as an LXP, talent mobility, career, and skills platform, has the potential to change the L&D landscape. Let me explain why.

First, Cornerstone is a large, global, and very successful company. Recently going private with a valuation over $5 Billion, the company has more than 75 million users, 6,000+ customers, and a product set that spans the entire range of learning and technology needs – from learning management to recruiting, talent management, performance management, and content.

Over the last two decades, Cornerstone has consistently outperformed its peers. Saba (now owned by Cornerstone), Plateau (acquired by SAP), and most of the other first-generation learning companies could not compete with Cornerstone – and this is a testament to the company’s customer focus, innovation, and strong sales and marketing.

In the last five years, however, Cornerstone appeared to fall behind. In 2016 the company introduced its Learning Experience Platform and a broad library of content (acquiring content company Grovo), but the LXP didn’t take off. Since then Cornerstone has been working hard, building a much more complete solution.

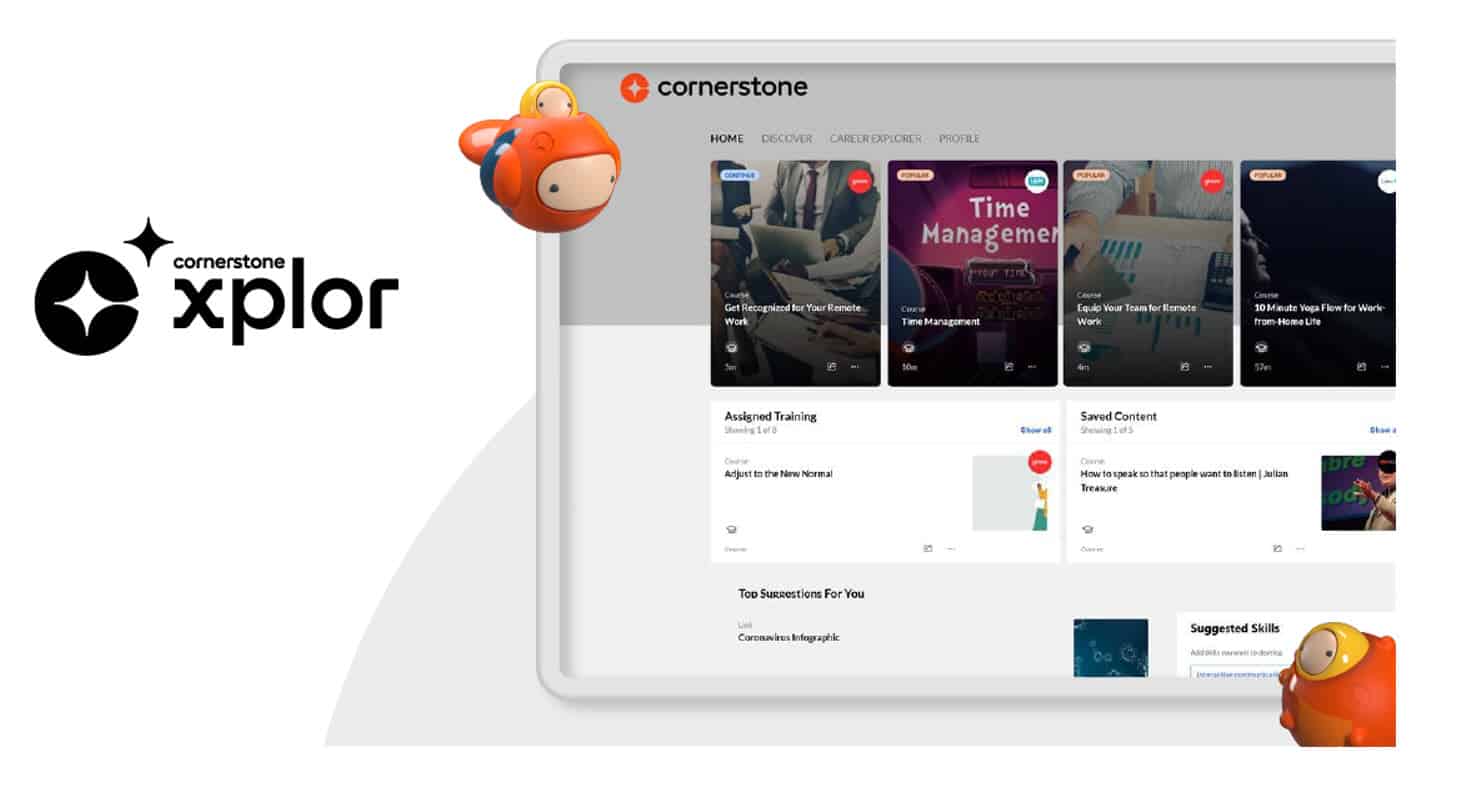

What is Cornerstone Xplor?

During its development phase, the company called it a PXP – a “People Experience Platform.” And while that name is not altogether clear, it is the company’s multi-year effort to build the “new learning platform” we all want for our organizations. It includes the features of an LXP (content discovery, indexing, career paths, self-authored content), Talent Marketplace (recommended jobs, development activities, projects), Career Portal (career recommendations, planned career paths), and Skills Engine (skills and experience indexing, intelligence, curation, and recommendation).

|

In many ways, it brings together the categories of LXP (Degreed, EdCast, LinkedIn Learning Hub), Talent Marketplace (Fuel50, Gloat, Hitch), Skills Engine (Eightfold, SkyHive, Workday Skills Cloud), and LMS. What better combination could there be?

And it’s interesting to me that all this happened while Cornerstone went private, the founder Adam Miller left his operational role, and the company completed its acquisitions of Saba, Halogen, Lumesse, Grovo, and Clustree. This, in a sense, is a whole new Cornerstone.

Where Does Cornerstone Xplor Fit?

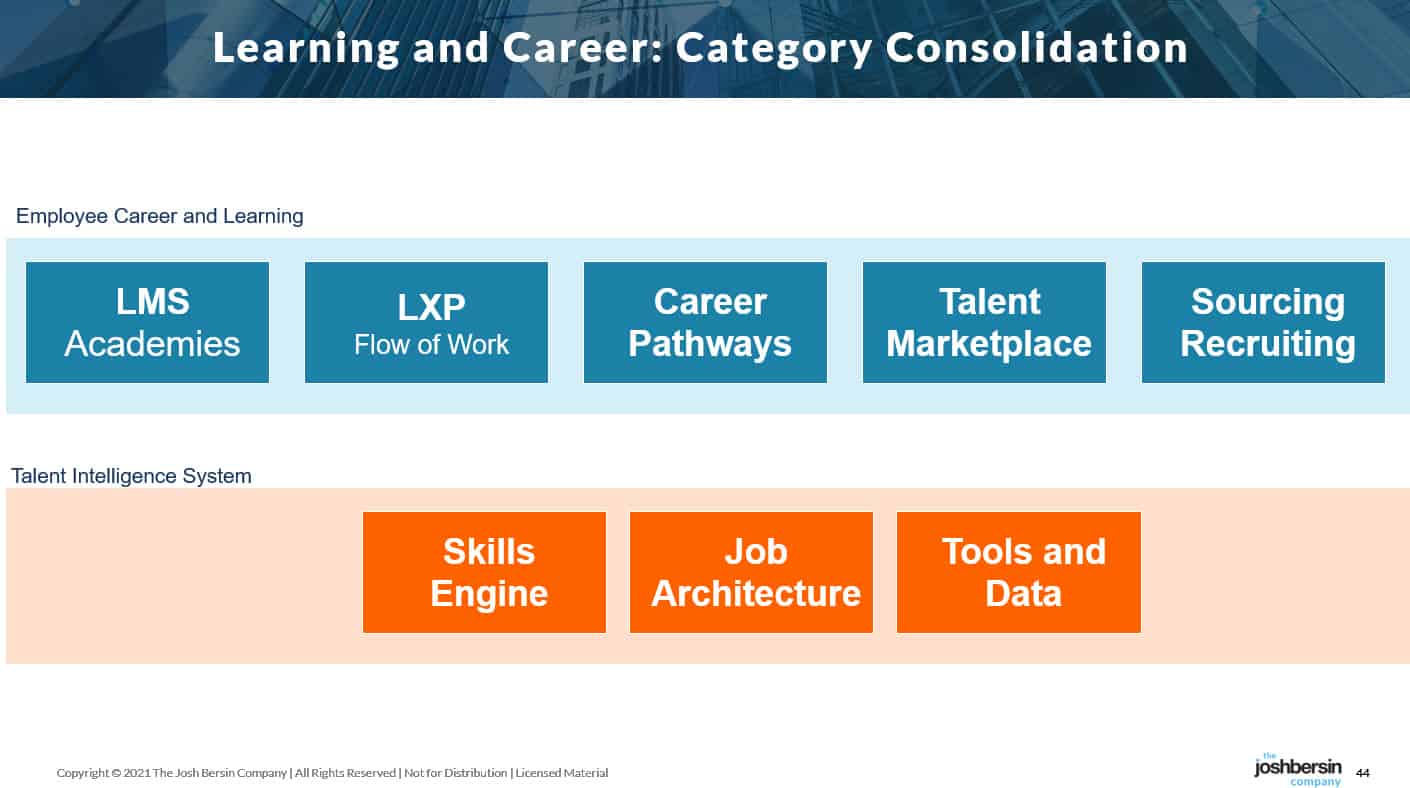

While the product is brand new, it has a unique and “market-changing” role in the market. Since the LXP market began (circa 2010), the learning and talent technology market has been fragmenting. Companies now have to buy an LMS (ie. Cornerstone), an LXP (ie. Degreed), a Talent Marketplace (ie. Gloat or Fuel50) and a Skills Engine (ie. Workday, Eightfold, others). And add to that the need for a skills-based recruiting platform (iCims, Beamery, Avature) and more.

|

Cornerstone has the opportunity to pull this all together. If it achieves its potential, Cornerstone Xplor could totally change the market. Companies may no longer want to invest in all these standalone skills-based platforms and now look for some integrated solution that pulls all this together. Cornerstone, as the market leader in enterprise learning platforms, could possibly be that system.

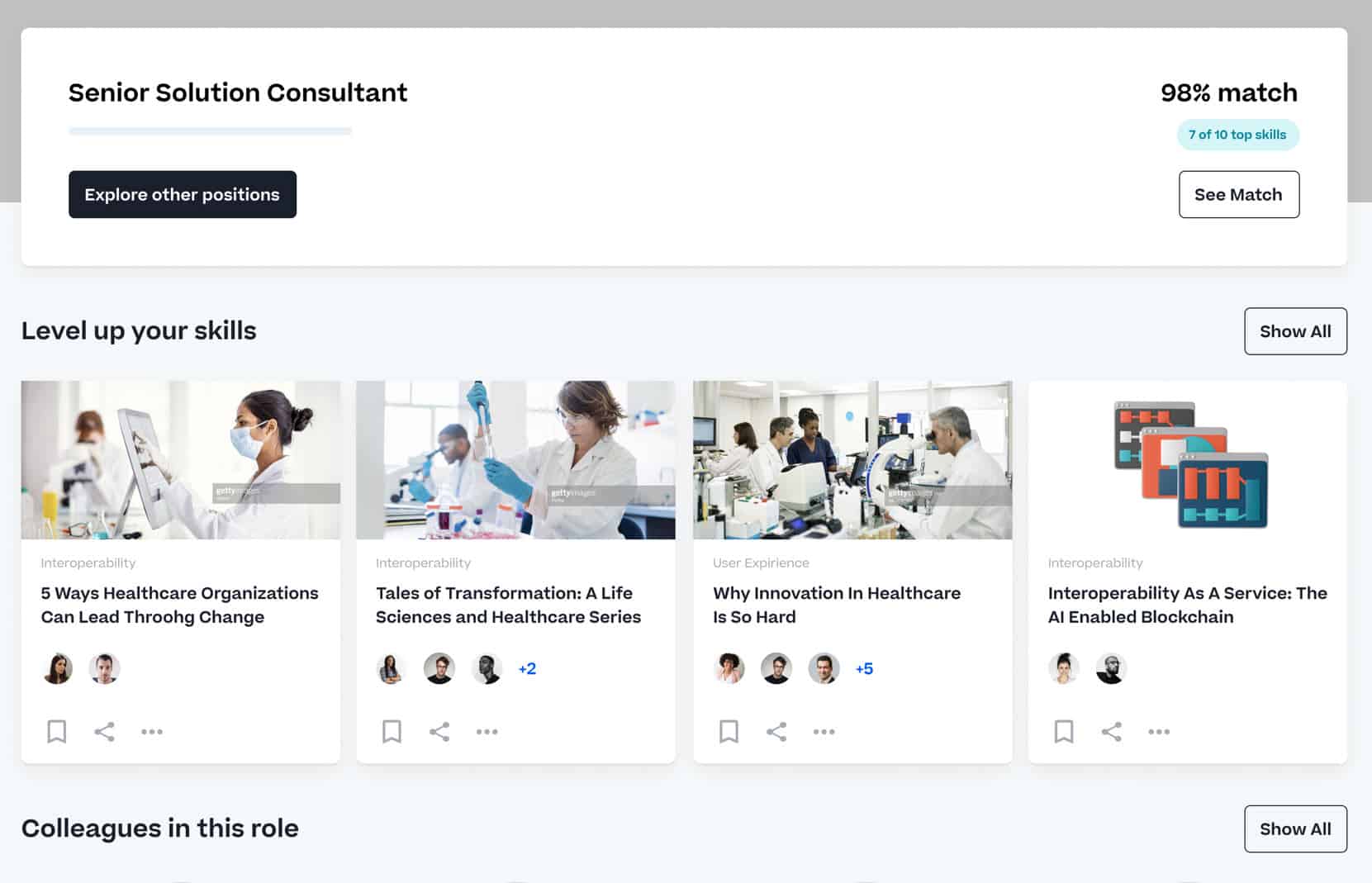

And the design of Cornerstone Xplor is impressive. Not only is the skills graph advanced (it already has 53,000 skills and has injested more than 250 million job roles), the system is designed to integrate and capture skills information from any document in the company. The LXP can not only “find and discover” learning but also includes content players so you can consume programs without logging into another system. And the administration is designed to be distributed, so you can build Capability Academies throughout the system, each managed by different teams.

Workday, SuccessFactors, Oracle, and Eightfold are going down the same path. These companies also see integrated skills-enabled technology as their core, and they too want to build a complete “Talent Intelligence” platform that does it all. But none of them have the customer base or learning business rules and workflows of Cornerstone.

And it goes even further. Cornerstone is not only a learning technology company, they are also a content provider. Cornerstone Xplor will come optimized out of the box for open content from the web, the company’s Content Anytime library of training, and Cornerstone Studio’s bespoke and Grovo microlearning content. The platform also connects to TalentLink, Cornerstone’s flagship Applicant Tracking and Candidate Marketing System, so it will index, search, and recommend job candidates, and deliver a skills-based approach to internal mobility.

This is a bold and important move for the company. Without this kind of product, Cornerstone remains a large, profitable company. With Cornerstone Xplor, the company now competes in the hottest parts of the HR Tech market and can greatly accelerate its growth. And with Cornerstone’s large customer base, this could change the market significantly.

Since Cornerstone has gone private, the company has transformed. The new head of product, Ajay Awatramani, comes from Adobe (and Marketo, Siebel) and has deep understanding how to build an easy-to-use but highly intelligent platform. This is a new Cornerstone, and I think the market will be surprised.

How The Learning, Career, and Skills Market Has Changed

Why does this product change the market? The pandemic has forced companies to transform, redeploy people, and radically rethink how they hire and train people. Every company we talk with is building new “Career Pathways” to help people transition from “the old role” to “the new one.”

For years we bought solutions in categories: a learning management system, a set of content offerings, a learning experience platform (LXP), a career portal, a recruiting system, and others.

Today, as the market explodes with growth ($260 Billion training market grew by over 11% this year), the market is coming together. Companies don’t want to integrate dozens of systems to help employees develop, upskill, and find new roles.

|

Cornerstone Xplor could be this new system. I believe these products could start the next wave of “category consolidation” as LXP, LMS, and Talent Marketplace products come together.

One final point. I’ve talked with a few early Cornerstone Xplor customers and they are totally thrilled.

One told me “Cornerstone Xplor runs circles around our ERP vendor’s vision for skills and learning. We have already implemented a skills-based Finance Academy with overwhelming success. We would not have been able to do this with an LXP or our other platform provider.”

Let’s hope Cornerstone Xplor is as successful as its potential: this could be good news for everyone.

Additional Resources

Cornerstone Goes Private: This Is All About Growth

Understanding SkillsTech, One Of The Biggest Trends in Business