The Workday Economy – As AI Disrupts, A New Strategy Emerges

By Kathi Enderes, SVP Research and Global Industry Analyst with comments by Josh Bersin

The Workday Innovation Summit 2025 was more than an analyst meeting: it was a signal that Workday is attempting a full-scale reinvention. Under CEO Carl Eschenbach and Board Chair Aneel Bhusri, Workday is shifting from a product-centric model to an open, partner-driven, AI-powered ecosystem they call “The Workday Economy.”

Let’s explain what the company is up to.

Strong Financial Performance

Now on its 20th birthday, Workday is in a position of strength:

– $7.7 billion in subscription revenue

– 16.9% year-over-year growth

– 11,000+ customers in 175+ countries

– 70 million users

– 93% customer satisfaction.

The company’s goal is to reach $10 billion over the next few years, which means continuing this level of growth.

Workday is banking on a few big bets: aggressive partnerships and industry solutions, building Agentic AI, investment in Workday Financials, and a mid-market offering. Let’s look at each of the components in detail.

|

The Platform Play: From System to Ecosystem

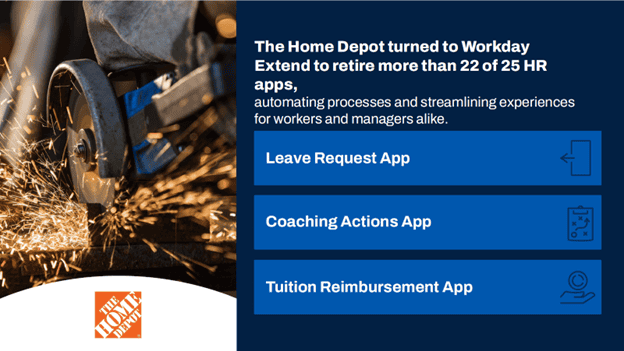

Workday’s legacy as a highly integrated, proprietary stack (or “walled garden”) worked for years, but now it slows innovation. Now, with intention to make Workday an open platform, the company is expanding its Built on Workday program and expanded Workday Marketplace, to build a “Workday Economy.” Partners and customers can use Workday Extend to build applications natively, with low-code tools and lots of support.

Comment by Josh: Workday Extend is a massive priority, but building Workday apps is difficult. With 87 partners now, how big can this app ecosystem become? And just as Apple tightly controls apps for the i-Phone, can Workday do the same with such complex industry partners? They’re definitely going in the right direction.

|

Partnerships as Engine of Innovation

Workday’s partner ecosystem is now front and center, supporting ISVs, advisory firms, system integrators, and co-innovation partners. A new Clear Skies Initiative is supposed to prevent channel conflict, ensuring partners can build without competing with Workday’s core offerings.

Strategic alliances with Randstad, TechWolf, and five new Workday Wellness partners (including MetLife) are examples. Can Workday use these partnerships to drive real, measurable results? Many partner programs are simply referral relationships: how will sales and service teams invest in the success of these partnerships? This is a new muscle for Workday to build.

Comment by Josh: This is big. I think Carl understands that Workday’s “market power,” built through its reputation over 20 years, lets the company pick winning partners and resell their offerings, invest in them, and stop trying to build or compete with everyone in this market. This is the type of behavior a $20-30 Billion company demonstrates, and I hope it continues. (ADP white labels many products and their business never stops growing.)

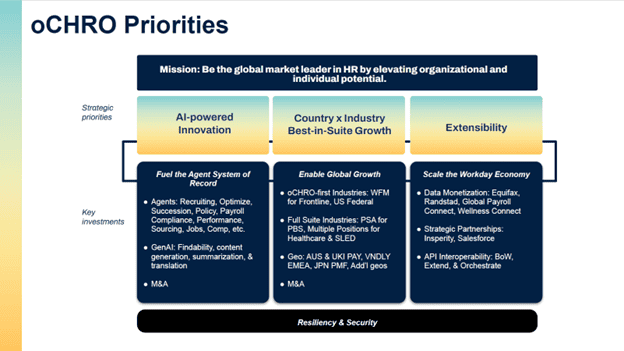

Agentic AI: The Next Frontier

Agentic AI is clearly core to the strategy. The Workday Assistant, powered by Illuminate, lets employees interact with HR and finance in natural language, across Microsoft Teams, Slack, and more.

Early agentic applications like the Payroll Agent, Employee Self-Service Agent, or Recruiting Agent are promising, but the real test will be customer adoption to create business value.

|

As companies deploy more specialized agents, Workday’s Agent System of Record aims to manage all agents, not just the ones created on Workday. With big players like Microsoft, Google, and ServiceNow aiming for the same level of control, this will be a tough battle to fight.

Comment by Josh: I’m not really convinced that Workday can be a system of record for agents, when the system is missing so much data. I would bet on Microsoft, Google, Okta, or others to dominate the agent governance market. On the other hand, agents that work with Workday (recruiting agents, L&D agents, pay agents, etc.) do have to integrate with Workday somehow, so to me this is a way to integrate, not “govern” agents.

Agent Extensibility and Customization

The new Workday Assistant Studio lets partners and customers build agents to fit unique workflows. This extensibility is good news for customers, but it comes with risk. How well will these interfaces work and how easy will it be for vendors to build integrated apps? Workday now has direct integration with Microsoft Copilot and Google, but most Agent-builders are going after customers directly, and they may or may not want to be held hostage within the Workday Assistant.

Comment from Josh: Right now SAP Joule is a year ahead of Workday in ERP/HCM Assistants. Most Workday clients I talk with are afraid to even let employees touch the system and they’re deploying Copilot, ChatGPT, Galileo, or other dedicated assistants. The Workday Assistant strategy needs a bold new move, and Studio alone may not be enough. I think Workday may be better off focusing on optimizing its utility within other more broad AI assistants. (What happened to Workday’s big alliance with Salesforce I wonder.)

HCM Innovation: Industry Focus and Acquisition Integration

Workday’s HCM suite remains the company’s core, with a focus on practical AI and the employee experience. Industry-specific solutions for higher education, healthcare, and financial services are expanding, offering another path to growth and becoming indispensable for clients.

|

Recent acquisitions like HiredScore, VNDLY, and Evisort can add mature AI-driven capabilities that can bring the HCM product (built 20 years ago) into the latest AI era, given the competition in this space. (Workday now resells Evisort.)

Comment from Josh: Workday HCM product teams understand what customers need. The challenge they face is “getting there from here,” so I would bet we see many more acquisitions. If you read our latest research on the Revolution in Corporate Learning, for example, you see that Workday has missed this market. Ditto many recruitment features (high-volume, online job previews, AI-assessment.) So I would expect Workday to do more deals like HiredScore, where they get an AI product base and some amazing HCM product talent.

Strong Focus on the Financial Suite

Workday’s financial management suite is now central to its growth story, with over 35% of new customers choosing it. The company is pushing industry-specific financial applications, automation, and real-time insights. But the finance function can often be conservative and risk-averse, and the promise of truly integrated HCM and Finance solutions is still a dream for most customers.

International Expansion

Workday’s global ambitions are bold. New offices, expanded partnerships, and talent programs in EMEA are all part of the plan. Today only 25% of revenue comes from international markets so the company will need to invest heavily here. SAP and Oracle are quite dominant in some countries, so the company has to pick its markets carefully.

And remember local players. As Workday courts the Global 2000 (including First-Citizens Bank & Trust, UnityPoint Health, and Toyota), the company definitely needs to build out support, partnerships, and presence in these geographies.

Comment from Josh: There are many geographies (Asia, UK, Eastern Europe) where Workday is not well entrenched. While SAP and Oracle dominate some of these markets, if Workday builds a strong partnership model (ie. exclusive SI partnerships in these geos, etc.) they can double their growth rate in these sectors. Look at how well Workday has done in Australia (a fairly small market).

Is the Mid-Market Ready for Workday?

Expanding to the mid-market is another tenant of Workday’s growth plan. With WorkdayGo, the company is adapting its enterprise playbook to leverage partners. With players like UKG, Rippling, ADP, Dayforce, and HiBob providing tailored, right-sized solutions designed for this segment, Workday will find lots of resistance in this market. (SAP tried this years ago.)

Comment from Josh: This is a push for me, I’m skeptical. I love Workday as a product but it’s very complex and needs major administrative support. I doubt Workday can effectively compete with HiBob, UKG, and the others Kathi mentions without building or buying a new product. Years ago Taleo (pioneer in ATS) acquired a separate company to launch Taleo Business Edition and that product sold like hotcakes. I have a hard time seeing how pre-configured Workday SKUs make it that much easier to administer. But who knows, maybe an AI-powered “configurator” could fix that up.

|

Customer-Centric Innovation

The 2025 Spring Release delivered over 350 new features, shaped by customer feedback. AI-powered talent rediscovery, simplified workflows, and industry-specific enhancements are all on the list. Customers are reportedly happy and shaping the roadmap. This pace of innovation requires companies to keep up with Workday, often not an easy feat, especially in the AI areas, where adoption still lags the many capabilities Workday offers. A focus on supporting AI transformation will be key to drive real value.

Josh’s Perspectives

Workday is an ambitious, well run, culture-driven company. These announcements signal a major shift from “technology-based” to “market-based” growth. There’s no question in my mind that thousands of ISVs and integrators would love to build businesses around Workday. The only question is how quickly Workday can make this easy and profitable (for them).

As far as AI goes, the market is very competitive. SAP’s AI strategy quite far along (Joule is more extensible than the Workday Assistant), and many AI startups are reinventing the HCM market from scratch. So while the Workday Agent System of Record makes sense, many new “Agent-core” or “AI-native” HCM apps will chip away at Workday’s footprint.

That all said, this is an exceptionally well run, strong, “Irresistible Organization”. With a new CTO and strong focus on global growth, I see no reason Workday can’t achieve its $10 Billion target in the next 3-4 years.

Additional Information

Galileo Learn™ – A Revolutionary Approach To Corporate Learning

The L&D Revolution: Docebo Goes AI-Native, Sana Expands, What Do You Do?

The End of HR As We Know It? AI Is Starting To Change Everything.