Ten New Truths About The HR Technology Market

Next week is the big HR Technology Conference and as I prepare my keynote I’ve had to review my last year of research with hundreds of vendors around the world. And rather than “write the book” at this moment, I want to give you “Ten New Truths” to consider with more to discuss next week. (You can listen to the discussion here.)

1/ Employee Experience takes over.

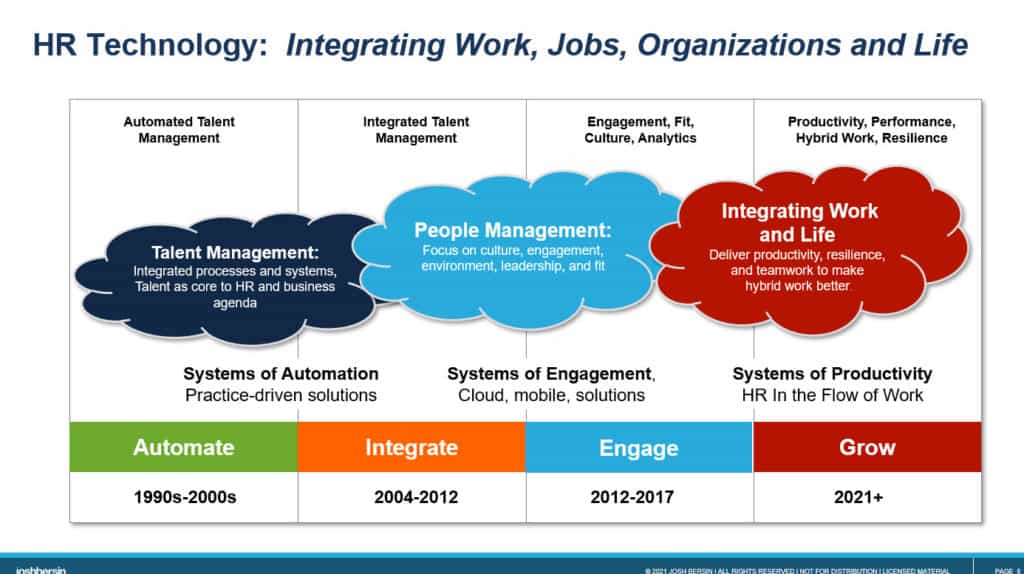

As you’ll hear in my keynote, EX is now at the center of the HR Tech market. Every tool, platform, and vendor is rotating in this direction and it’s all for good reason. Thanks to the pandemic, the number one issue in HR is engaging, supporting, and caring for people. And the new dimensions of remote work, hybrid work, and contingent work are on everyone’s plate.

What this means to HR Tech vendors is that everyone wants to build an “experience layer” that sits in front of employees. This, of course, is impossible – employees will never want to learn how to use 100 different tools to get things done. So there are the “EXP” vendors and the “EX contributing” vendors.

|

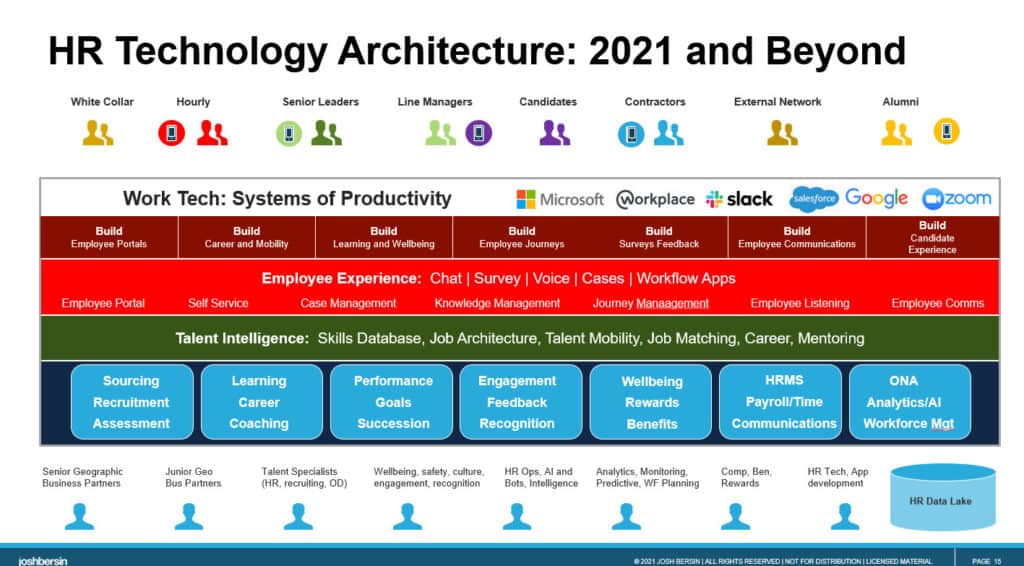

As I discuss in the podcast and will explain next week, this means that all HR Technology has to plug into productivity tools, creating a new “software stack” to consider. Take a look at the picture below: every HR Tech vendor has to figure out where they play in this landscape.

|

The bottom (blue) is the transaction layer, where the myriad of HR applications capture transactions, workflows, and information about workers. Above this is the intelligence layer, where the system combines data about people with external data (job market data, external skills models) to create career recommendations, skills ontologies, and matches between people and opportunities. Next is the experience layer, where we create user-portals, workflows, and various support services like case management and knowledge management. Above this is a layer of “Creator tools” that let us build, customize, and configure what employees see and consume. And above this, all these apps have to interact with the systems of productivity.

In reality, of course, HR Tech is a market of “products” and “platforms” that fit together to make all this work. But ultimately each product tends to focus on one of these layers, with some vendors building all levels.

And I know that HR departments struggle with this. Where do we put our Employee Portal? How will we deploy integrated communications to all our stakeholders? Where do we build the new onboarding or leadership solution? I was on the phone with a client last week who told me “we have BetterUp, Bravely, Harvard Manage Mentor, and Korn Ferry Assessments – how do we build an integrated leadership experience?” This type of conversation is happening all the time.

2/ ERP still strong, redefined.

As I mentioned in the podcast, ERP platforms are bigger than ever. Integrated HCM and payroll systems like Workday, Oracle, SuccessFactors, UKG, ADP, Paychex, Paycor, Namely, BambooHR, Gusto, HiBob, and many others are becoming large and ever-growing companies. These systems are not going away – in fact, they’re all experiencing growth.

What’s new is that they’re redefining their offerings. While many of these vendors have a wide range of features, they’re each adding learning, career, wellbeing, analytics, performance management, and their own EX layers as well. The next disruption is figuring out how the “talent intelligence” layer gets built (shown in green above), which is the software that lets you adapt your org model, job architecture, and identifies and uses skills. This layer of software has become a completely separate market (vendors like Eightfold, Gloat, Fuel50, Hitch, Degreed, SkyHive, and others).

|

HCM and ERP vendors are in a complicated position. They have to design improved tools for employee experience and simultaneously decide how much of the “blue layer” they build. And Microsoft and ServiceNow are starting to slowly encroach on their territory.

Despite all this, ERP, HCM, and payroll platforms remain critical. Companies need a core “system of record” and they always will. Eventually, someone will build a “next-gen HCM” (ie. ADP is working on it) but it isn’t here yet.

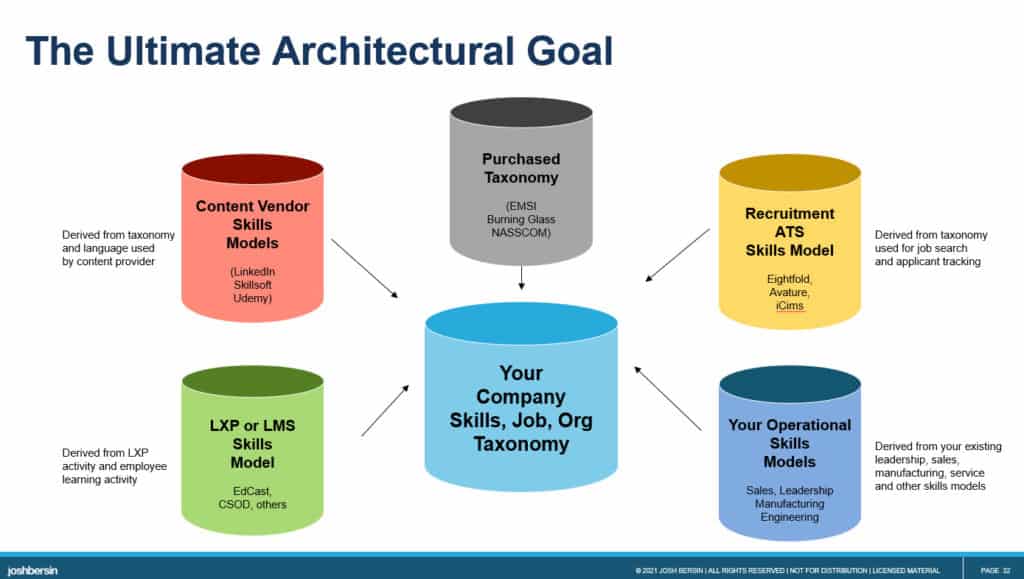

3/ Skills Taxonomies and Intelligence Platforms are the “next big thing.”

Hang onto your hat: skills engines, skills inference, and talent intelligence systems are taking over. Every vendor from Gloat to Degreed to EdCast to Cornerstone now has a built-in skills engine. And the more integrated solutions like Workday, Eightfold, Oracle, (and soon SAP) are building skills engines that cross all the talent applications.

The problem for buyers is that one “integrated skills platform” does not yet exist. And as you decide where to put this information, you realize that third-party data is critical. Advanced vendors like Workday, Eightfold, Censia, and Skyhive integrate data from many external systems (EMSI-BurningGlass, IT skills libraries, and dozens of other sources). So this new “Skills Engine” you build will be a living, breathing system.

|

4/ Recruiting and internal mobility collide.

Recruiting is a very hot market. Most of the recruiting vendors (iCims, Phenom, Avature, SmartRecruiters, Eightfold) are growing quickly and many have Unicorn valuations. Where are they going? As I discuss in the podcast, two big things are happening.

First, they’re being forced to source internal and external candidates. This means they’re turning into Talent Marketplaces (which is a robust market of its own). Second, they’re becoming ever-more sophisticated at the candidate experience (read item 1 above), AI-enabled sourcing and assessment, and workflow management. Avature, who we worked with on Talent Acquisition at a Crossroads, can now manage every possible scenario for recruiting and its customers are using the platform for onboarding, first-year performance management, and more. Eightfold can manage sourcing, recruiting, internal mobility, and skills ontology.

This is a fantastically healthy market, and while some of the mid-market vendors have been acquired, the enterprise vendors are innovating rapidly.

5/ Learning in the flow of work has arrived.

While I didn’t come up with the idea, I’ve been explaining and popularizing this paradigm for a while. Well, it is now here, so ignore it at your peril. Employees are consuming vast amounts of learning right now, all for good reason. They want to stay healthy, learn their new jobs, and understand how to manage their complicated lives. But they don’t have time for 2-hour elapsed online courses, so we need to give them “semi-synchronous” learning experiences (like we do in the Josh Bersin Academy) and lots of micro-learning, self-authored resources, and new modalities.

VR is a fast-growing market now, and vendors like Mursion and STRIVR Labs could become unicorns next. Content vendors like Udemy (a disruptive marketplace provider), Coursera, and LinkedIn Learning are growing at high double-digit rates, and providers like Skillsoft, Cornerstone, and many others offer exciting new content that people can consume on-demand. (Go1, one of the biggest content aggregators, now has a Unicorn valuation.) And thanks to platforms like Degreed, EdCast, LinkedIn Learning Hub (going GA this quarter), Viva Learning, and Percipio – you can find “just what you need” at scale.

That all said, there is still high demand for Capability Academies, so providers like NovoEd, Nomadic, 360Learning, Docebo, Fuse Universal, Totara, and others remain strong. These platforms create integrated and highly configurable learning experiences so they’re also in high demand. Leveraging the focus on skills and capabilities, these providers are inventing new models for cohort-based learning, collaborative learning, and self-authored content.

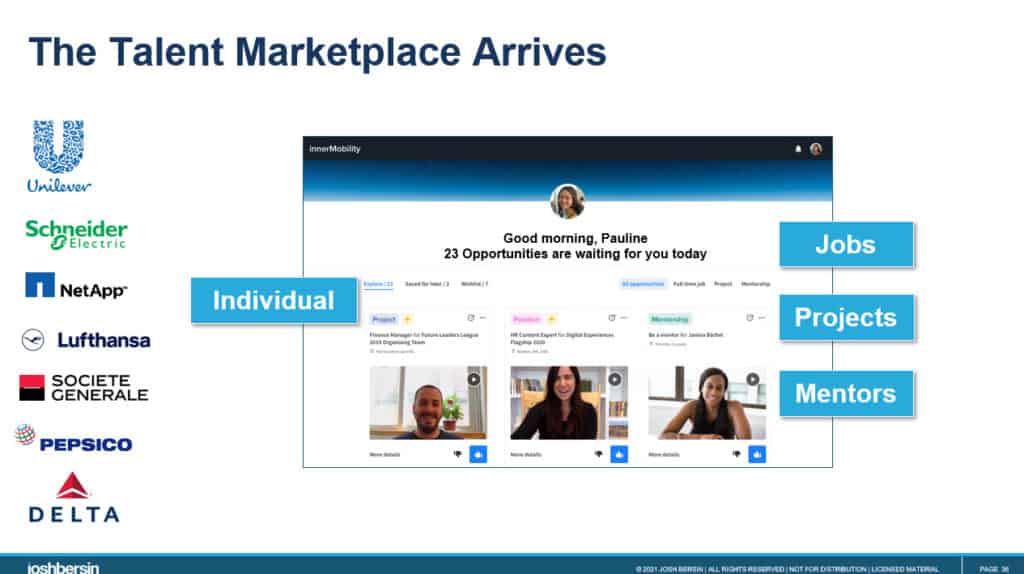

6/ Talent Marketplace has become a category.

As I talk about in the podcast, vendors like Gloat and Fuel50 (each claim to have “invented” the market) are growing like crazy, and that’s for good reason. Of all the new offerings I’ve studied over the years, this is the only HR Tech space that seems to be universally successful. Every company that has deployed a Talent Marketplace is happy, so I will simply state that “you need to put this on your list.”

|

The vendor market looks crowded (Gloat, Fuel50, Hitch, Eightfold, Workday, Oracle, iCims, Avature, PeopleFluent, SuccessFactors, Cornerstone, Degreed, and more) but these vendors are each very different. I won’t get into the details here, but the “New Truth” is that internal mobility, internal gig work, and marketplace-based mentoring and coaching is white-hot. Most of you will look into this in 2022, and the market will decide whether this remains a standalone market or a set of “features” in the ERP.

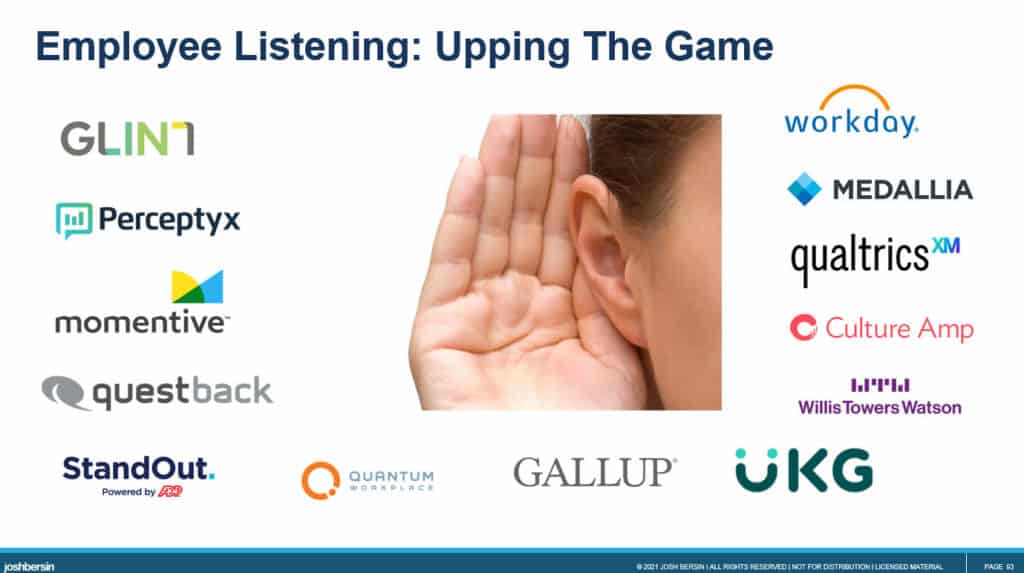

7/ Employee listening explodes with growth.

This is an exciting trend: integrated employee listening platforms have become a robust market. It isn’t enough to buy a fantastic survey system: you need a system that does pulse surveys, annual surveys, open-ended surveys, 360 multi-rater surveys, crowdsourcing, video and audio analysis, and even website analysis. And you want all this information in one database with real-time analytics so service centers, HR business partners, and line managers can use it.

|

The big vendors here are Glint, Medallia, Perceptyx, Peakon, Qualtrics, and others. As I’ll discuss in the speech, these are mission-critical systems, and if you don’t have something like this you can’t really “shorten the distance between signal and action.” (Our new Employee Experience research found that employee listening is the #1 tech driver of engagement during the pandemic!). This market grew over the last 8 years and it’s now robust, advanced, and ready to replace your standalone survey tools.

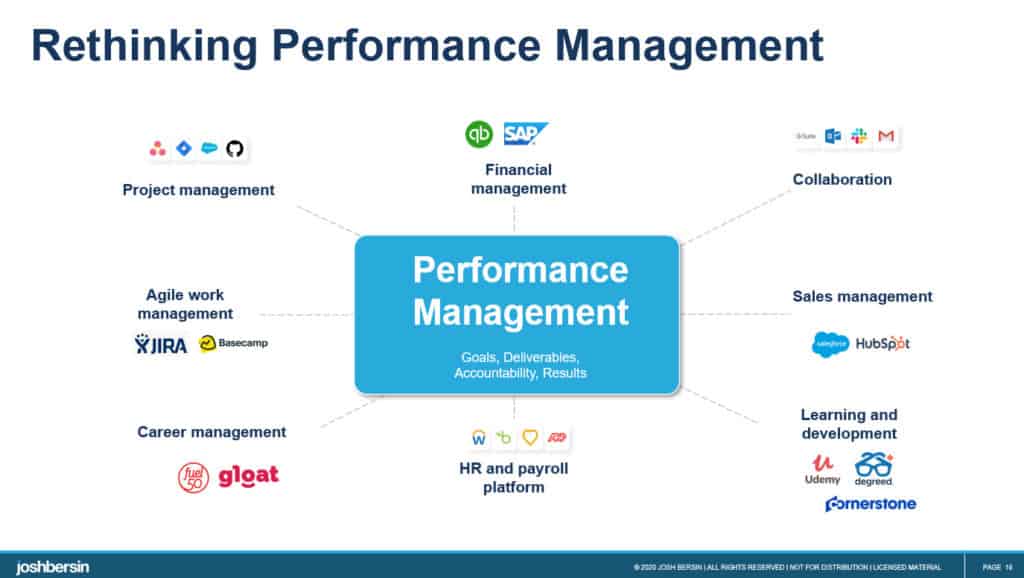

8/ Performance, talent and learning converge.

The performance management software market has been bloody and difficult for vendors. Many of the most innovative vendors were acquired (Reflektiv, Highground, Zugata) but some are growing like crazy (Lattice, BetterWorks, Workboard). Last week BetterUp acquired Impraise, which gives you a sense of where BetterUp is going. And when Workday acquired Peakon they got their hands on a pretty cool next-gen performance system.

The big direction is away from standalone PM tools toward much more integrated “management platforms.” This is where Lattice, BetterWorks, Workboard, and 15Five are going. They’re building integrated “management platforms” that can help teams, individuals, leaders, and HR manage projects, performance processes, development, and rewards. While we used to call this “integrated talent management,” I prefer to call these “management platforms.” And these tools embrace top-down goal alignment, OKRs, and all sorts of other models for goal setting.

The ERP/HCM vendors each have tools in this area, but they typically don’t put a lot of energy into them. Workday is likely to do something innovative with Peakon and SuccessFactors continues to innovate, but these new vendors are really doing something different. They’re building integrated “management systems” that help team leaders, managers, and executives manage their people, coupled with HR. And as you know, every company with more than 100 employees does performance management in some form.

|

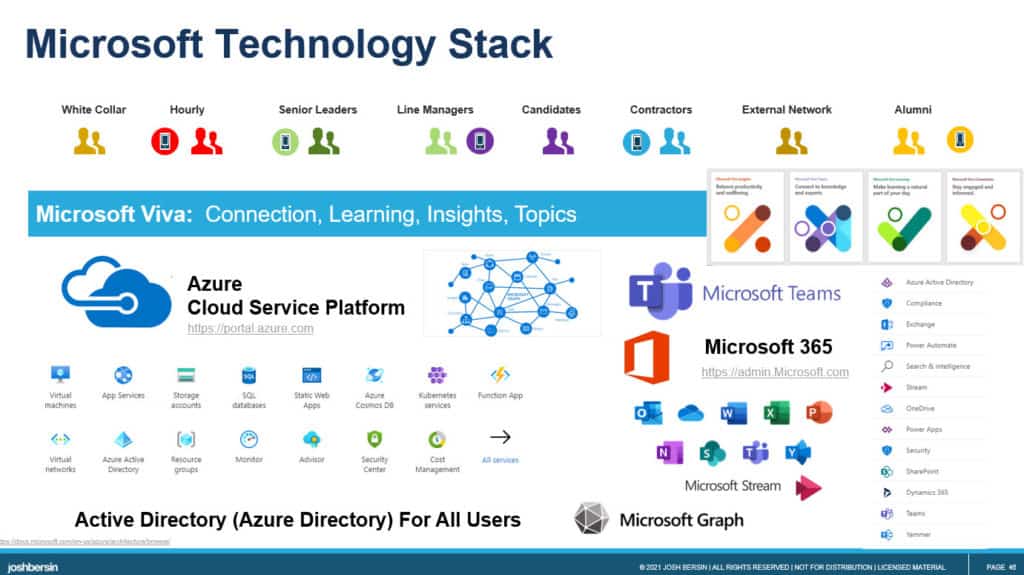

9/ Microsoft changes HR Tech forever.

You cannot underestimate the impact of Microsoft on this market. Two years ago nobody thought about Microsoft for HR Tech. Today everybody is. With the combination of Viva, LinkedIn, and the new Teams features, Microsoft is soon to deliver an end-to-end employee experience, collaboration, portal, and learning solution that IT departments may adore. While the product set is new, it is forcing every vendor to create a Teams app and now lets Microsoft study the HR space in detail.

|

I know for a fact that Microsoft is very serious about this market, and the Viva product set has now moved into mainstream Microsoft sales. You should look at what they’re doing and make sure you see if it fits. If you”re a big Google Workspace shop, I’d expect them to wake up to this market within the next year or two. And Workplace by Facebook, Webex, and Zoom are nipping at the edges of HR too. But to me, Microsoft is the one to pay attention to.

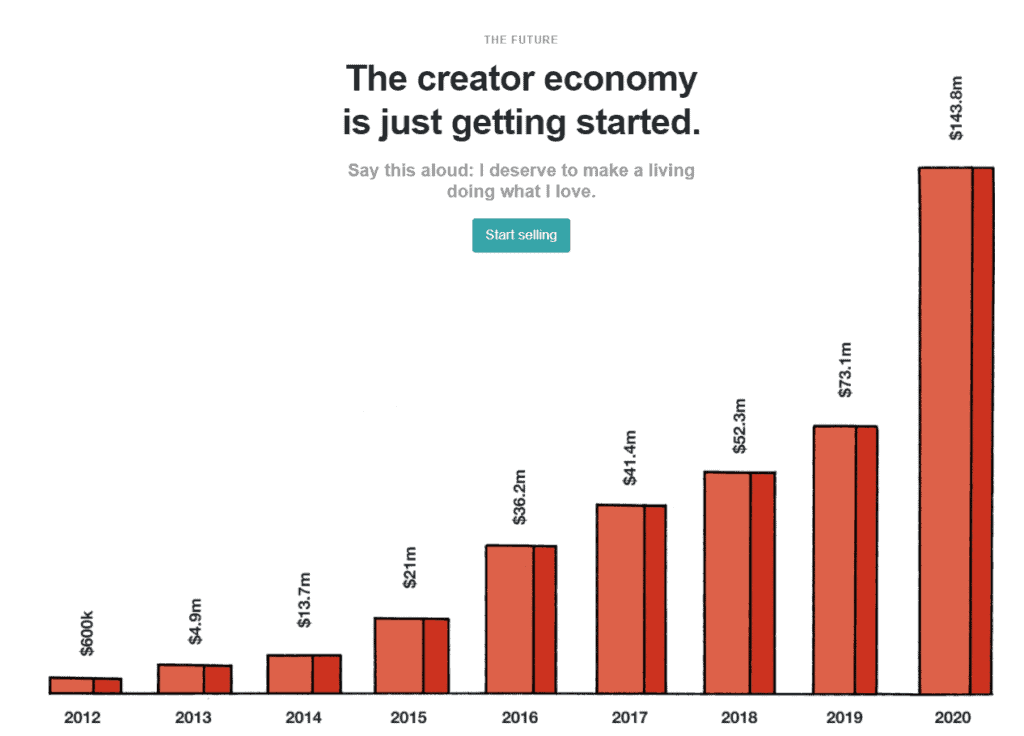

10/ Watch out for The Creator Economy.

My final “New Truth” is the incredible power of Creators. The Creator Economy tools (TikTok, Instagram, Snapchat, Twitter, Facebook, Reddit, Pinterest) now command over $100 Billion in valuation and grew by over 40% last year. This entire new market is now coming to HR.

|

We are desperate for Creator platforms in HR: we want to create learning content, employee journeys, feedback systems, back-to-work tools, reporting and analytics interfaces, and lots of communication and change programs. We don’t want HR Tech platforms that “do what is designed” – we want systems that let us create our own content, our own customizations, and our own innovative ideas. So in many ways, all HR Tech platforms are becoming “Creator Systems.”

Let me cite just a few examples: ServiceNow, 360Learning, Articulate, Docebo, and Udemy. ServiceNow’s “citizen developer” interface lets companies build their own workflow, journeys, and work management and scheduling apps with ease. 360Learning has built a huge business enabling any subject matter expert to author courses and instructional programs. Articulate is the #1 provider of easy-to-use content development tools for e-learning and just received $1.2 Billion in funding (!). Docebo has unlocked the power of “learning as a product” and lets you create your own learning business. And Udemy is growing at 2-3 times its competitors because it is a “Creator Platform” for tech and business experts.

This idea, using HR Tech to “build” not just “configure and deploy,” is a theme in every market. Ask your vendor to give you a “developer tool” for their platform, and you’ll be amazed at what you can do.

That’s enough for now. Come to the HR Technology Conference, listen to the Podcast, or email me if you’d like to learn more.

Additional Resources

HR Technology 2021: The Definitive Guide

Fixing Your Job Architecture: A New Business Imperative

Understanding SkillsTech, One Of The Biggest Markets In Business