Learning Technologies Group Acquires GP Strategies: Learning Consulting Is Hot

This week the Learning Technologies Group announced the acquisition of GP Strategies, one of the mainstay training delivery and consultants in the world. Together the combined company will be over $750 Million in revenue and starts to look like one of the largest corporate learning consultancies in the world.

LTG has an interesting history. Over the years the company (Publicly traded as LTG.L) has acquired a wide variety of learning and talent technology companies and now owns one of the most complete “arsenals” of various systems used in corporate training, recruiting, and talent management. The company is valued at over $1.6 Billion (12 X revenues) and has a wide variety of learning technologies to sell. These products are each branded independently, making LTG look more like a portfolio company before the GP acquisition.

These technologies cover the entire tapestry of corporate learning needs: Gomo Learning is a video and HTML authoring system; Rustici Software provides one of the industry-leading Learning Record Store (LRS) systems and XAPI expertise; PeopleFluent is a mid-sized provider of end-to-end talent management, high volume recruiting, and internal talent mobility software; Affirmity is a DEI consulting and service provider; Watershed is one of the leading LRS solutions (read more here); VectorVMS is a talent sourcing system for contract labor; Breezy is mid-market recruiting system; Instilled is one of the leading LXP products; Open LMS is a complete LMS system built on open-source; Bridge is one of the most complete end-to-end mid-market LMS and talent platforms.

I’ve followed almost all these companies over their lifecycle and each product team has devoted customers, deep expertise in their domain, and competitive features. And in many cases these were companies that built great technology but for some reason (often management team or market savvy) they did not grow at the rate they hoped so they were eventually acquired by LTG.

What is LTG really all about? Is the company a product firm or a consulting firm?

As I talked with Piers Lea recently, he reaffirmed that LTG’s mission is to help companies make sense of this highly messy, complicated domain. The corporate learning market is one of the largest and most complex markets in business, and there are hundreds of tools, technologies, content providers, and approaches to every problem. Our research shows that this entire market is well over $240 Billion in size and it has become one of the most essential business needs during the last fifteen years of economic transformation.

So does this make LTG one of the biggest? It depends on how you look at the market. L&D buyers have essentially three ways to acquire solutions:

First, you can go out and buy tools and content on your own, and act as your own systems integrator.

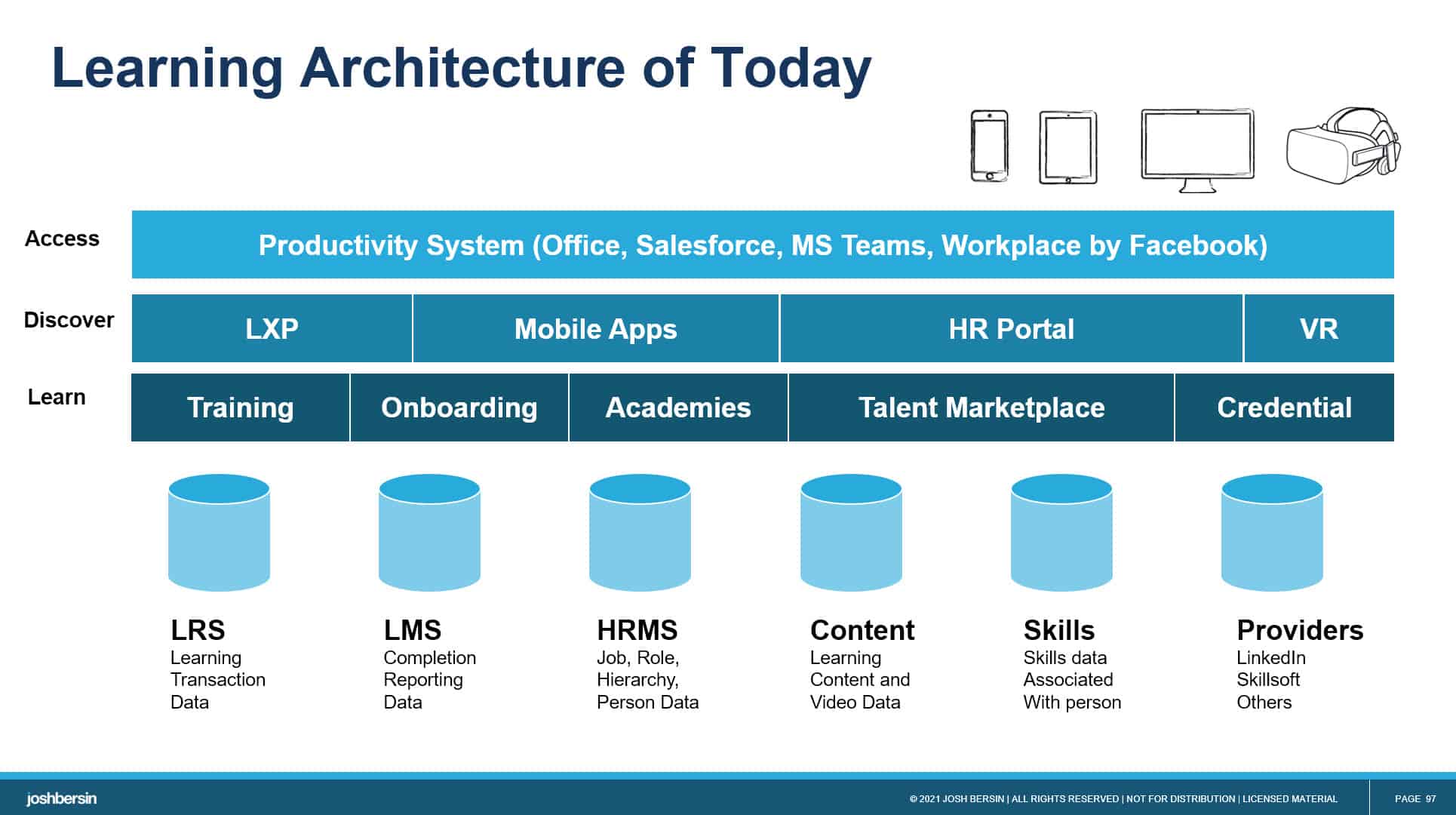

Most companies do this all the time, and they wind up with a training function filled with systems and content, often becoming a complex mess over time. Large companies like Wal-Mart, Verizon, and AstraZeneca put heavy investment into their L&D stack, and they build entire architectures to make all this work together. (Read our in-depth research on the LRS market and learning data architectures for more detail.)

|

If you go this route you need to study the market and you’re likely to find some or many of LTG’s products on your list. That said, the L&D market is what we call a “red ocean” – there are few open blue ocean markets available. Every vendor has dozens of competitors, and it is often the savvy of the founder and their marketing, sales, and product strategy that drives growth. Every L&D vendor I talk with (and I know most of them) has lots of successful customers, but many don’t reach more than $40-50 Million in revenue, because the market is so complex.

LTG’s strategy here is to meet these buyers where they are and differentiate these products to grow their revenue streams over time. This means that LTG can continue to acquire smaller or mid-sized L&D technology companies, and simply put them into the portfolio.

Second, you can go out and find a specialist.

GP Strategies is a specialist which generates $495 Million in training services and delivery. They were not growing particularly well, and their history goes way back to nuclear power plant certification – so the company needed a shot in the arm. But LTG, once this acquisition is complete, gains a deep level of expertise and experience developing and delivering training to millions of people every year. Here the company has to manage this team well: each buyer of GP Strategies services has lots of other options.

The vendor I want to point out here is NIIT, a company we’ve partnered with in our Adaptive Learning research and content development. NIIT is a highly expert team of 2600+ people with 34 global design, service, and delivery centers around the world. They, to me, were the nemesis of GP Strategies, and while they don’t buy up learning tech companies, they have grown at a profitable rate for more than 30 years. NIIT’s clients include many of the world’s largest companies, and I think the LTG acquisition could create opportunity for NIIT in the market.

The vendor I want to point out here is NIIT, a company we’ve partnered with in our Adaptive Learning research and content development. NIIT is a highly expert team of 2600+ people with 34 global design, service, and delivery centers around the world. They, to me, were the nemesis of GP Strategies, and while they don’t buy up learning tech companies, they have grown at a profitable rate for more than 30 years. NIIT’s clients include many of the world’s largest companies, and I think the LTG acquisition could create opportunity for NIIT in the market.

I won’t try to rate NIIT vs. GP Strategies directly, but NIIT’s independence from technology vendors gives them some advantages. They work with any and all L&D technologies, and they are also experts in VR, micro-learning, adaptive learning, and learning in the flow of work. And this is how complex this has become: today companies want capability academies, skills taxonomies, virtual reality, and all sorts of micro-learning, credentialing, and industry-specific content.

The third part of this market is the big systems integrators: IBM, Accenture, EY, PwC, and Deloitte.

These companies each have large and well-established learning practices, but they each have different strategies. When we were at Deloitte we were part of a fast-growing learning business that helped with content strategy, technology implementation, and large strategic change projects. We were not experts in all the tools, but we partnered with vendors wherever it seemed to make sense.

Similarly, the other providers each pick their partners and often build their own solutions. Accenture, for example, offers the Accenture Academy (we are partnering with Accenture as their HR Academy), and lots of tools for skills inference, taxonomy development, and content management. IBM offers Your Learning, a highly engineered outsourced learning platform that was built for use within IBM. PwC offers ProEdge, a specialized content platform for professional and technical development. And E-Y is expanding its Tech MBA, a credentialed learning solution for business professionals in all areas. These unique offerings appeal to many buyers, so they often play in clients who know them well.

LTG, which is now a large and global company, has the opportunity to play at this level. The company has a complex and interesting business model: a portfolio of product brands coupled with a large consulting and services business. While I know most investors like businesses to be pure and easy to understand, in this complex market a hybrid approach of selling branded products and consulting does make sense.

Additional Resources

What Is A Capability Academy? Here Is The Answer.

Instructure Sells Bridge to LTG for $50 M

A New Model For Corporate Training: The Adaptive Learning Organization