ServiceNow Acquires Hitch: Entering The Skills And HCM Market

Today was some big news. ServiceNow, the leader in enterprise workflow and employee experience platforms, announced the acquisition of Hitch, a small player in the massive market for skills technology and talent marketplace solutions. This puts ServiceNow in direct competition with Workday, Oracle, SAP, and a flurry of others, and opens up the big question: where does my skills data belong?

Let me explain what’s going on, and give you a sense of what ServiceNow is up to.

First, this is a growth play.

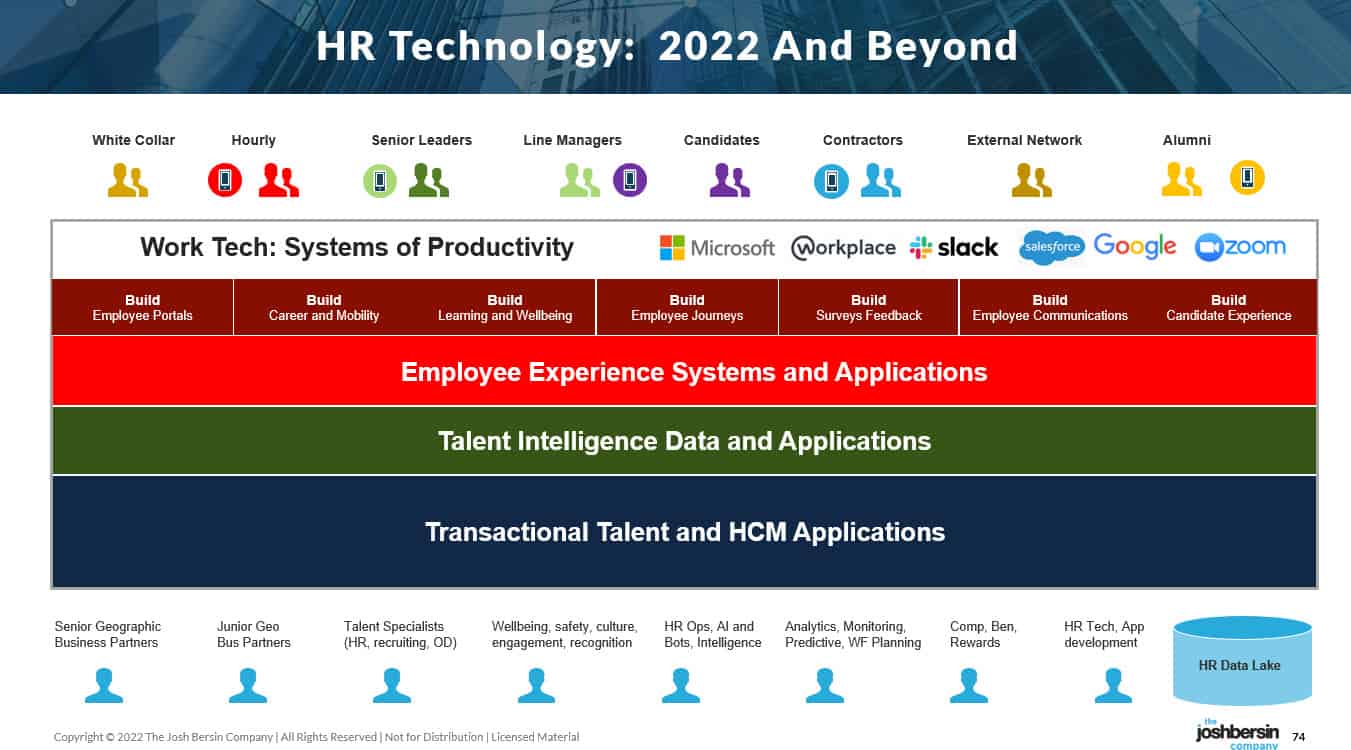

ServiceNow is a very successful software company, and they need new avenues for growth. Today the company is worth over $100 Billion (more than 2x Workday), and it trades at lofty valuations of more than 20X revenue. ServiceNow leads the market for IT and HR service management and has successfully created a new marketplace for Employee Workflow and employee experience platforms.

Initially, the platform focused on case and knowledge management, service delivery automation, and important applications for IT and HR self-service. Over the last two years the company expanded into hybrid work management, workplace scheduling, employee portals, and mobile apps. And all this is built on a scalable workflow platform (the Now platform) that lets any user develop applications that can use, leverage, and integrate data from other corporate systems.

Today ServiceNow has 7,400 customers (80% of the Fortune 500), and most of these buyers are IT and HR, generating over $1.7 Billion last quarter.

What’s next? Extending ServiceNow into employee-facing applications. And that’s where Hitch comes in. By adding a new set of skills-based tools (for employee learning, growth, mobility, and transitions), ServiceNow can move deeper into new markets and grow. And the skills-based HR market (talent marketplace, employee development, career management) is huge.

Second, this is a strategic shift.

But there’s really something more going on. ServiceNow is expanding its surface area, moving beyond service delivery into real employee applications and HCM. And they’re building an entire workflow management platform, which operates independently from your HCM.

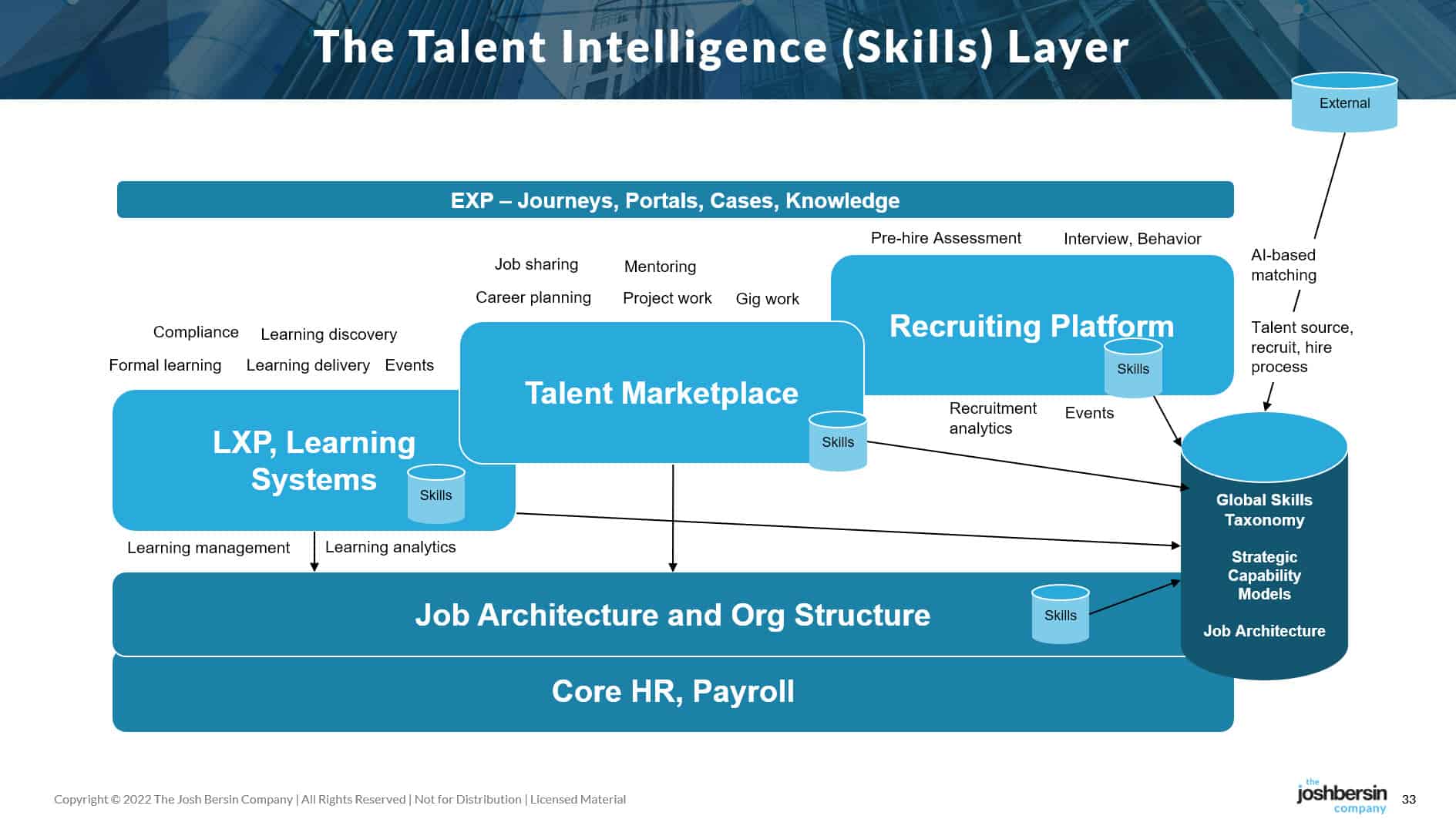

If you look at the skills problem at work, you realize it’s very complex, highly distributed, and constantly changing. We have a proliferation of HR tools trying to manage skills: training platforms, recruitment systems, compliance programs, badging, and internal mobility systems. So what most companies want to do is tie this all together.

|

The traditional approach is to centralize: build a “global skills taxonomy.” But that really isn’t working. No matter how hard you try to centralize this information, new jobs, roles, and technologies appear all the time. So line managers, supervisors, and regional teams need to build onboarding, training, and various applications fast. They can’t wait for the core HR function to adapt to their needs.

Imagine you’re a customer service manager and you are building a new onboarding program. Are you going to wait for the L&D department to work with HR to build a skills model, a set of skills tools, and possibly use the core HCM system to put this together? Ideally, you would, but it may take a year or two and your operations are changing all the time.

What if, instead, you “integrated” or “developed” the skills taxonomy you need in ServiceNow and let the ServiceNow toolset assemble the content, onboarding process, and completion record you need? If you already own ServiceNow, this is a pretty easy exercise. And the ServiceNow toolset can import skills from other systems as needed (thanks to Hitch)

This is where ServiceNow wants to go.

|

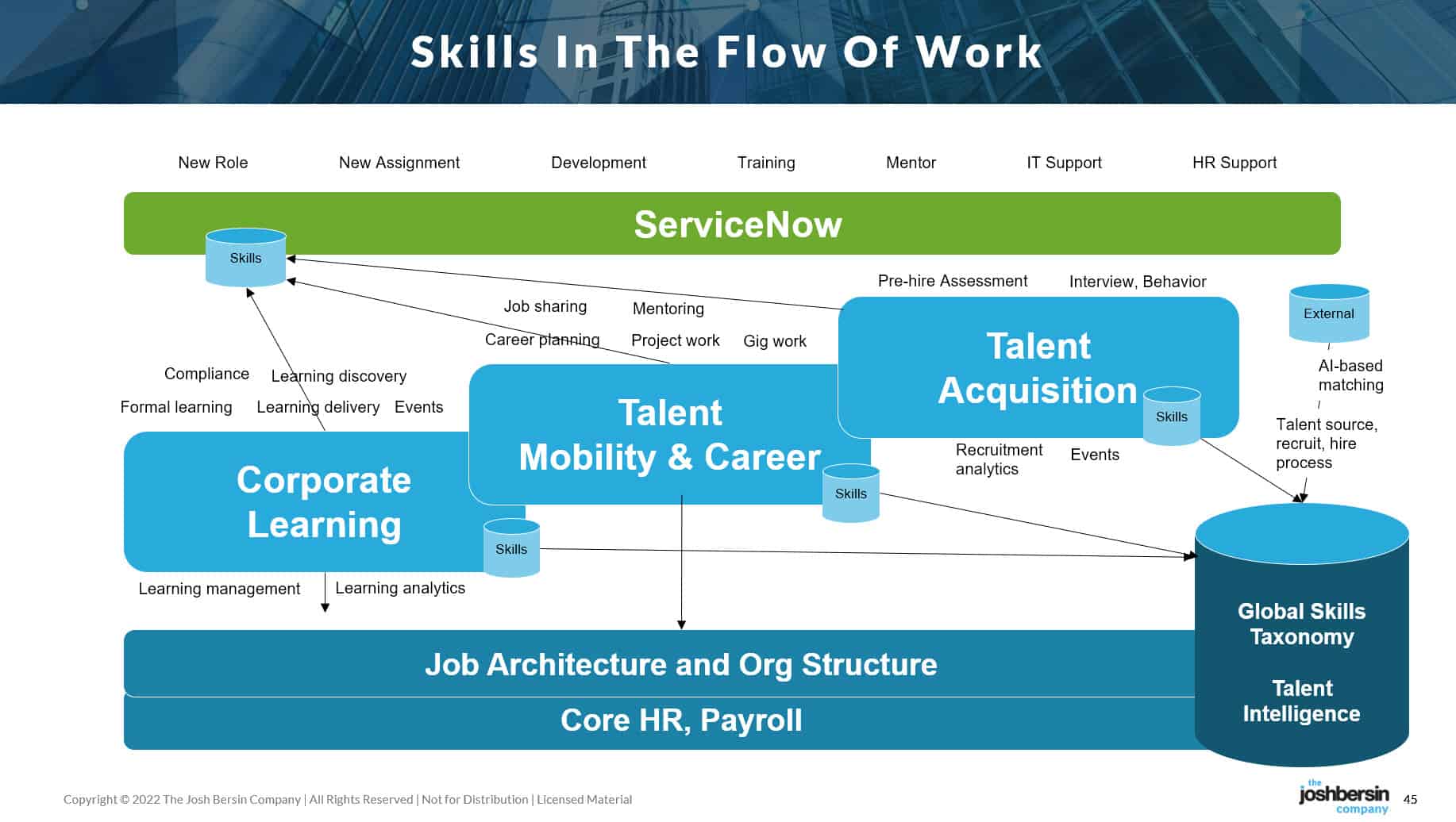

Skills In The Flow Of Work

What ServiceNow is proposing is a “federated model” for skills: one where there are many skills systems, each using skills data for its own unique needs. And this, believe it or not, is where the market is headed.

ServiceNow, as a vendor familiar with “connecting and integrating” legacy systems, sees this as an opportunity. Through the acquisition of Hitch, ServiceNow has the tools to let you build a functional, geographic, or corporate skills model and immediately use it for ServiceNow journeys, workflows, learning journeys, and customized experiences. And they can import, integrate, and coordinate this data with other systems.

While centralization is appealing, this federated approach is where the market is going. As I’ve talked about all year with clients, the center of gravity in HR (and IT) has moved from “systems of record” to “systems of experience.” Companies want tools that let managers, employees, and HR teams build apps, design journeys, listen to employees, and simplify the IT mess. Microsoft Viva, which already has more than 10,000 customers, was launched precisely for this reason.

|

The Tricky Part: ServiceNow is moving from a Blue Ocean into a Red Ocean.

As I talked this over with the product team, I mentioned that even for ServiceNow, this is a tricky move. Once you start promoting selling “skills intelligence,” you run into customers with lots of experience and opinions. And in many ways, the market for skills and talent mobility software is the most “red ocean” you could find.

Hitch, founded by Kelly Steven-Waiss, ran into this problem in their engagements. While they did some big deals, every customer asked how they compared with Workday, Oracle, Gloat, Eightfold, Beamery, iCims, Cornerstone, and more. ServiceNow is going to have to navigate this space.

But the world has to move on, and ServiceNow’s focus on “employee workflows first, core data second” has been successful. So this new strategy is likely to pick up steam.

I have incredible respect for ServiceNow. And I know that with leaders like McDermott and product leaders like Gretchen Alarcon, the company knows what it’s getting into.

If this works out, it could double the size of ServiceNow. And I know they have more to come.

We will be staying very close to this one. If you’re looking at building out your own talent intelligence, skills, and internal mobility strategy give us a call. We’ll help you sort it all out.

Additional Resources

The Mad Scramble To Lead The Talent Marketplace Market

Cornerstone Acquires Edcast: Consolidation in LXP and Skills Market