The Market Slows: What Should Employers Do?

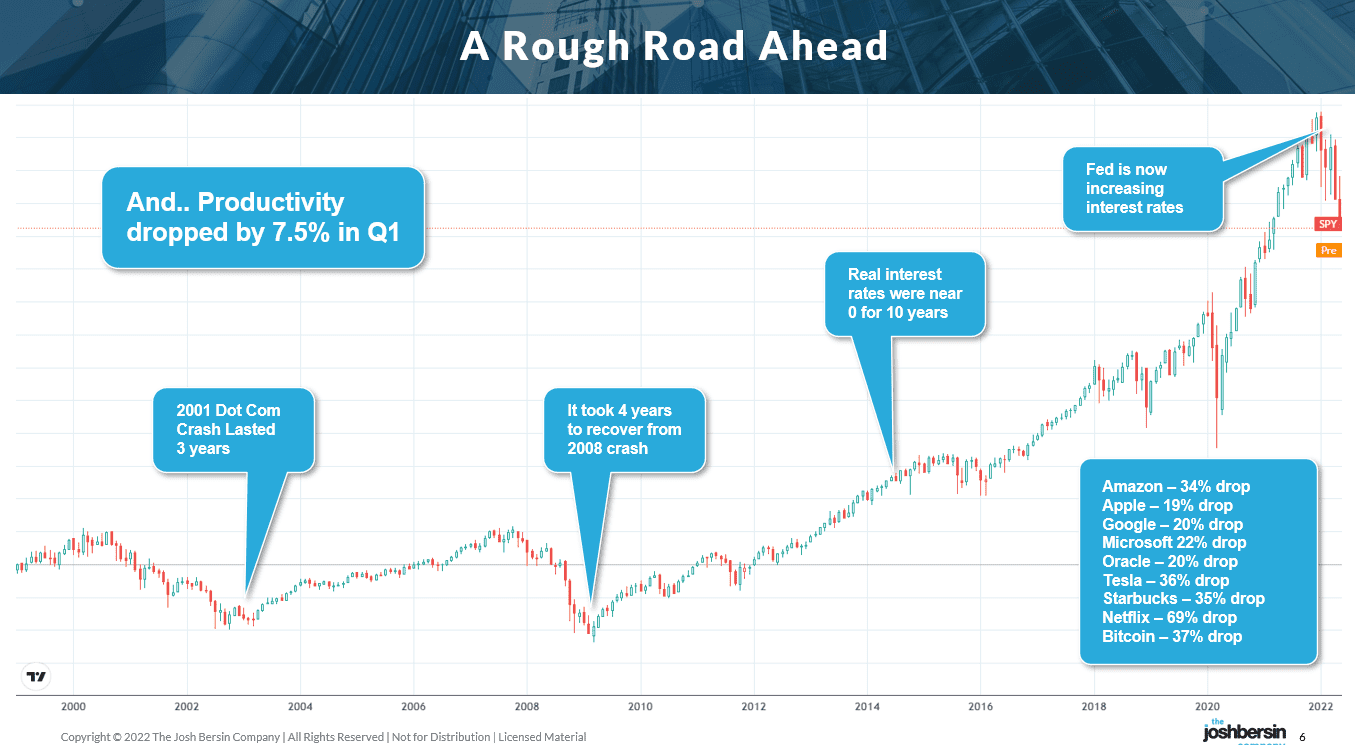

Over the last few months, the stock and bond markets have been devastated. After nearly twelve years of effectively zero interest rates, the US Fed is raising rates steadily. Why? The government has been flooding the market with cash for a decade and it’s time to clean things up.

While this is not going to be fun for stock market investors, it actually creates what we call a “trader’s market.” In other words, as prices and wages go up and asset prices go down, it’s time for you (as an investor and employer) to carefully select what you invest in. (Bitcoin is down more than 30% this year too, by the way, so the only real “safe” asset has been gold.)

|

As an older and more conservative investor, I would suggest that this is also a big lesson for employers. GDP growth is slowing, productivity took a huge hit (wages have outpaced workforce output), and interest rates are going up. Now is the time to “select your workforce” carefully. Just as investors want to buy the best possible stocks at the right price, now is the time to hire the “right people” with the right compensation and benefits.

While focusing on the quality of hire seems obvious, people have lost this discipline. Over the last decade, many companies hired desperately. I’ve talked with software companies that used the “get big fast” model and now find themselves facing layoffs, budget cuts, and slowdowns. It’s not a fun experience. (Facebook, Uber, Twitter and many others have halted or slowed hiring.)

How do you carefully hire in a market like this? As our new Human-Centered Talent Acquisition research points out, there are four essential rules here.

First, it’s not good enough to “hire to fill jobs.” Now is a good time to push back on all the open requisitions and ask your hiring managers “why are you hiring for this position?” Is your team really optimized and productive? Our new research Organization Design: The Real Secret To Growth, is perfectly timed here.

Second, you have to carefully refine, redefine, and communicate your employment brand. And I don’t mean your logo or tagline. What does your company do and why? Why should a high-value job seeker or college grad select your company to join? And are you ready to pay a competitive wage in this inflationary economy?

These issues are often called “the Deal” – what you offer to job seekers. And you have to look at it regularly. Companies like Cisco, Meta, Microsoft, Salesforce, and non-tech companies like Moderna, Nestle and others are all raising wages. And they’re not just doing this to keep up – they want and expect “the best candidates” to apply.

If we do enter a slowdown, we’re going to have to revisit pay, rewards, and benefits. Over the last 14 years, companies have heavily invested in their people, and wages continue to rise. This is not a bad thing, but our research shows that it’s our “total offer” that matters, and this goes well beyond pay, benefits, and perks.

Third, in a time of “stock picking,” you should be picking internal candidates. This is the equivalent of “asset reallocation.” In an investment portfolio, we regularly balance funds between stocks, bonds, and fixed assets. This is what should be happening inside your company too. If your sales team is growing but your marketing budget is reduced, move people from marketing to sales.

On a more strategic basis, our new Global Workforce Intelligence research shows that companies in healthcare and banking, for example, are quickly creating new career pathways to develop clinical professionals, mid-office analysts and bank managers, and both blockchain, cyber, and cloud engineers. You don’t need to hire these people externally, you can build and move them inside your company. This is the equivalent of “selling high priced bonds to buy low priced stocks,” in a way.

In HR we call this “internal talent mobility” or “talent marketplace.” And for those of you in recruiting or talent management, it’s one of the hottest trends in HR.

The fourth thing to do is focus on candidate experience. When the stock market crashes, savvy investors start analyzing new stocks. Just as Warren Buffet has an uncanny way of finding good values in even the worst of times, you should be doing the same thing. Great people may start leaving poorly run companies. This means doing highly strategic sourcing, building up your Talent Intelligence group (more on that soon), and making it easy for candidates to find the right job and apply.

Just as you want to “source” great bargains when prices go down (asset prices, not gas prices), now is the time to start finding skilled people who want to upgrade their careers. As the economy slows (which is clearly coming soon), lots of great employees are going to stop jumping into new jobs. So the sooner you “upgrade your workforce” the better you’ll be prepared for the next few years. (PS. Check out layoffs.fyi if you want to see who’s getting laid off.)

Underneath all this is a need for strategic Talent Intelligence and a deep and enduring focus on making your company an Irresistible place to work. And that means wages, benefits, and designing the company around people, not outcomes.

Come to our Irresistible Conference next month in Los Angeles (beautiful USC campus) to learn more, and stay tuned for much more on this urgent and timely topic.

Additional Resources

Recruiting Is Harder Than It Looks: 74% Of Companies Underperform

Irresistible. The Global Conference for HR Leaders and Their Teams