What Should We Do About Inflation?

Everywhere you go people are talking about inflation. And for good reason: this month we saw an annual 7% inflation rate, the biggest gain in 39 years. And as I see it, this is likely to continue, so what are we going to do?

First, Why The Inflation?

While there are many contributing causes, this is a long-term problem that has been building for a decade. US and Global interest rates have been almost zero for a decade, encouraging people to buy houses, cars, and borrow money. With a lack of return on bonds, trillions of dollars have gone into the stock market, driving it to P/E multiples higher than we’ve seen in 20 years. And now that consumer demand is high (US GDP grew at 7% last year), there are shortages of everything. Even people.

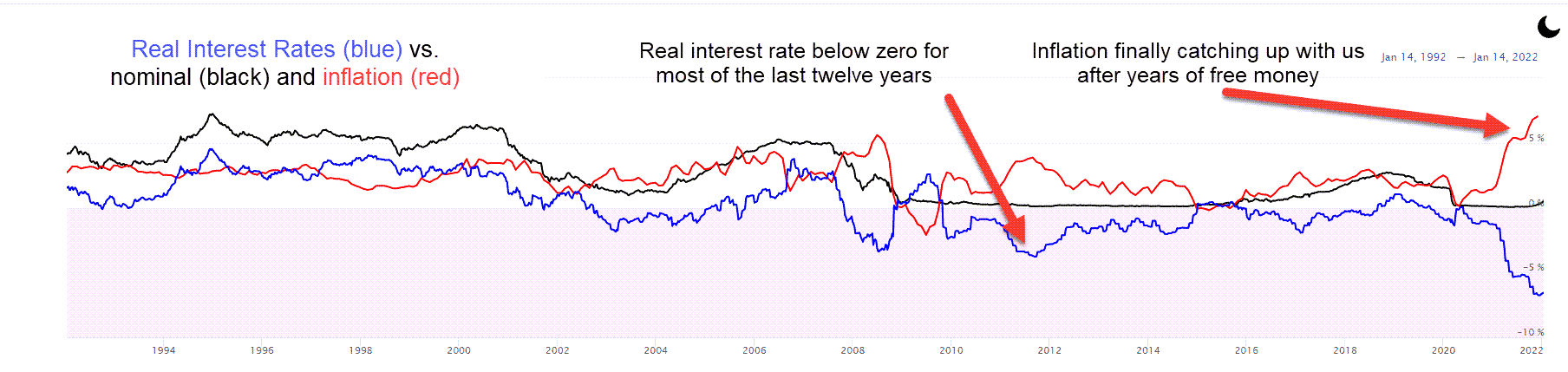

And added to this, the US Government poured several trillion dollars into the economy in the last two years, followed by a tax cut four years earlier. So there is a lot of money chasing limited goods and not enough workers to keep up. So I don’t believe this problem will go away quickly. (The following chart show “nominal” interest rates (the ones you see), vs. “real” interest rates (interest after inflation) and you can see that money has been essentially “free” since the 2008 recession.

|

Yes, the Fed will raise interest rates, but they are afraid to puncture the stock market bubble, so it will likely happen slowly. And the inflation genie is already out of the bottle.

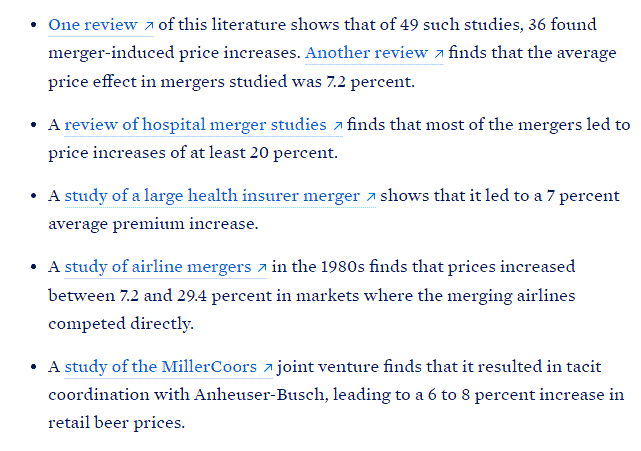

Note that there are structural issues as well. The US economy is more concentrated than ever (five companies make up 23% of the S&P 500). Research shows that 75% of industries have experienced an increase in concentration levels, prompting the Biden Administration to put an entire task force on the problem. I find the evidence pretty convincing: Tech, Airlines, Healthcare, Financial Services, Retail – are all experiencing concentration effects.

|

Economists call this “unearned rent” – when a company charges a higher price because of their market dominance, and there is no real productive value delivered. And this creates inflation. (Mariana Mazzucato‘s books and articles point this out very eloquently.)

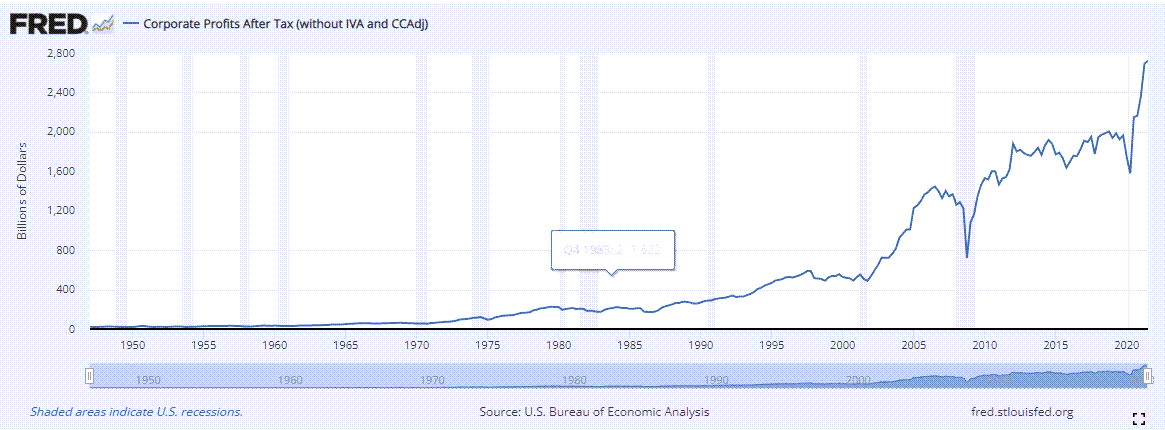

Look, for example, at corporate profits over the last thirty years. It’s almost an exponential curve upward. Companies like Apple, Google, Facebook, Amazon, and Microsoft now have tens of billions of dollars of profit, and that “excess rent” is raising prices.

This week I noticed, for example, that Netflix “decided” to raise fees by $2 per month. The company already generates $1.8 Billion in profits, which went up 83% year over year. Why are they raising fees? Because they can.

|

I’m not here to argue against capitalism or Milton Friedman (who preached that the purpose of business is to increase profits), but we’re all paying the price for “winner take all” markets. We have fewer and fewer options for many of our purchases, and regardless of what companies tell the regulators, big companies have pricing power.

And incidentally, I’m not sure we can really believe what the Fed is saying. The Fed now states that inflation will drop to 2.6% by the end of 2022, yet their projections are way off. Just a few weeks ago they forecast that inflation would be 2-2.5%. They were off by more than a factor of 3.

|

The Impact of Inflation

As I discuss in the podcast this week, inflation creates several problems.

First, the psychological impact is high. Inflation, unlike unemployment, impacts everyone. Every citizen, every consumer sees prices going up, so we all feel upset. Many political revolutions are caused by rampant inflation, because it makes people feel that the government (and businesses) are out of control.

The US administration knows this. Now the US Government is starting to “blame” oil companies for raising prices, yet they are just doing what Milton Friedman told them to do. This sense of what I call “shifting sands” makes everyone uneasy, and we start blaming companies and businesses for raising prices. (I think it’s interesting that both Walmart and Target, two of the best-run retailers in the world, pride themselves on giving consumers affordable prices. Amazon is clearly no longer going in this direction.)

Second, of course, the job market gets heated. While many workers are still underpaid (20 states still have minimum wages below $15 per hour), most are seeing wages go up. US hourly workers in leisure and hospitality saw a 12% increase in wages over the last 11 months. And software engineers, salespeople, nurses, and many professional services workers are seeing wages higher than ever. Deloitte just allocated a billion dollars to its payroll to make sure its busy consultants don’t leave.

What Should Employers (and managers) Do?

This has many impacts on you as an employer. As I detail in the podcast, a few things are important:

First, it’s time to focus on your pay practices and improve transparency, frequency of reviews, and the fairness of your performance process. People want and expect more money and you have to be sure you’re clearly and consistently explaining your policies. It’s ok for you to pay less than your peers, but you have to explain why and what the employment value proposition is all about.

Second, it’s time to revisit entry-level and hourly pay and make sure it’s keeping up. Despite the increases we’ve seen, new research shows that hourly wages are still not keeping up with inflation.

As I discuss in the podcast, raising wages is not a bad thing, so be prepared for a discussion with your CFO. Consider the impact of an open position or a high turnover rate: the cost of losing or “not having” a person can be very high. When you raise wages you attract more skilled people, you reduce turnover, and you increase employee engagement. People work harder, promote your brand, and lean into your business.

Costco, for example, has been one of the most profitable retailers for years and has always paid above-average wages. One of the most compelling studies of this topic was done by Zeynep Tom in The Good Jobs Strategy, a book I highly recommend. She clearly points out that the retailers with the highest wages are the most profitable and sustainable over time.

Third, it’s time to double down on your employment brand. Why should someone really come work for you? What do you offer above pay and benefits? Now is the time to seriously focus on the career growth, mobility, experience, and reputation you bring to your employees. If your company won’t look good on their resume as an employer, they’re going to expect more money.

Fourth, as I discussed in my article about Human-Centered Recruiting, it’s time to listen to your recruiters. What are candidates asking for? Why aren’t they joining your company? Not only do you want to be well known, you want to be well-liked. Treating people well and focusing on employee experience is essential in times like this. Do you really want to suffer 60% turnover rates like Amazon? I doubt it.

Fifth, I recommend you conduct a conjoint analysis and serious look at your benefits. What do employees really value and are you spending your money in the right place? This boom won’t go on forever so it’s well worth your time to seriously study what benefits your people value. Then you can refocus your rewards in the most valued categories and programs.

Finally, it’s time to seriously look at your performance management process. In inflationary times strong performers will look around. They’ll expect more money and they won’t wait a long time to get it. If you’re stuck with an entitled or highly political process, it won’t’ fare well in a period like we’re entering now.

Inflation Will Change Your Talent Strategy

All these are good business practices, but there’s also a bigger topic to discuss. When wages go up and it’s harder to hire people, companies also look to reorganize and automate in response. Most line managers simply hire to “fill open slots.” They don’t have the time or expertise to re-engineer how work gets done.

Just take nursing as an example. There are almost 800,000 nursing and direct care jobs available right now, and nursing schools will only graduate 175,000 nurses this year. Healthcare companies have no choice but to implement telemedicine, better self-diagnostics, new delivery systems, and self-service education for patients.

Now is the time to think hard about how you’re organized, and where automation can make work more productive. A dollar spent on automation now will not increase in cost over time, so inflation actually makes automation even more cost-effective. Our upcoming new research on Organization Design (coming soon) will help you figure this out.

In the meantime, inflation is here for a while and we all have to get ready.

As always please call us if you’d like any help.

Additional Resources

The Healthy Organization: An Integrated Approach to Wellbeing, Productivity, and Employee Brand