HR Tech Is White Hot: Is Every Vendor Now A Unicorn?

The HR Tech market is as hot as I’ve ever seen it, with most of the funding announcements showing $ Billion valuations. As I like to tell my neighbors, a Billion Dollars ain’t what it used to be. But it’s still a lot of money.

Why the growth? Virtually every economic signal points toward more HR Tech. Pandemic? We need HR Tech to help people work at home. Hybrid-Work? We need HR Tech to schedule people coming back. Hot Job Market? We need HR Tech to find, hire, and retain people to grow. Digital Transformation? We need HR Tech to reskill, upskill, and re-credential our workforce.

Maybe I’m a bit biased, but almost every issue in the economy leads to a problem of training, skilling, recruiting, or business management. And that’s why these deals keep coming. A few examples:

Go1 Raises $200M At $1B Valuation.

The corporate learning market is bigger than you realize. Every business needs training and education, and the topics range from compliance to technical training to vast topics in all different domains. And there are more than 100 million businesses around the world, each with a need for content.

Up until the last few years, this was a huge cottage industry with lots and lots of players. Big companies have training managers and Chief Learning Officers who shop for content and providers. But like the market for all retail products, some people just hate looking around so they want “one-stop shopping.” Enter Go1.

Go1, which has only one direct competitor (another successful company called OpenSesame), has pioneered the market for the “middleman” or “Spotify” of corporate learning. No, they’re not an LXP provider, they’re a content company – one with a vast library of 150,000+ titles, access to the world’s best content (including our Josh Bersin Academy), and an easy-to-buy, easy-to-use business model.

Today the company received a $200M investment from several big investors (Microsoft, Salesforce, Softbank) and the company is now valued at over $1 billion.

SmartRecruiters Raises $110M At $1.5 B Valuation.

Jerome Ternynck, the founder of SmartRecruiters, is a seasoned veteran in recruitment technology. His iconic company Mr. Ted was one of the fastest-growing HR Tech companies in the early 2000s and was acquired by Lumesse in 2010 (Lumesse is now part of Cornerstone). Since then, he started SmartRecruiters as a mid-market ATS platform and has since grown it into one of the leading enterprise solutions. SmartRecruiters competes with Avature, PhenomPeople, Oracle, iCims, and many of the ERP vendors.

In the last 12 months, the company added 200+ enterprise customers, grew revenue 50%, and experienced 70% bookings growth, demonstrating both the company’s strength and the rapid transformation in the recruiting market. Today they announced a raise of $110M at a $1.5 B Valuation, which also shows the enormous potential in the new breed of HR Tech.

Other High Valued Unicorns.

Let me highlight some other Unicorns in our market.

BetterUp, the fast-growing coaching and development company, is valued at over $1.7 Billion. Their success has attracted lots of money to that space, with vendors like Torch now nipping at their heels.

Eightfold.ai, the leader in AI-enabled talent intelligence, is valued at well over $1 Billion and just received $300M. This is a company that has disrupted recruiting in a big way and has the potential to take over a lot of other HR technology segments, built around its advanced AI-enabled platform.

Visier, the pioneer and leader in People Analytics, just raised $125 M with a $1 Billion valuation.

Docebo (now public), a new breed LMS company, is now valued at over $2 Billion and is growing by more than 60% annually. No LMS company has grown at this rate for a long time.

Articulate Global, one of the leaders in content development tools, just received $1.5 Billion in funding (I’ll tell you more about this in time). They are part of the Creator Platform for Learning Market, one that is just getting started.

Lattice, a performance management platform that mid-sized companies love, is now valued at $1 Billion (the first PM company to do this since SuccessFactors was acquired by SAP), creating interest in vendors like 15Five, Workboard, Betterworks, and TinyPulse. CultureAmp, another pioneer in this space, could be close to this kind of valuation. And TinyPulse, one of the pioneers in mid-market performance and engagement, was just acquired by Limeade, again showing market opportunity.

Mindtickle, a platform designed for sales training, micro-learning, and knowledge management, just raised $100M and is valued at $1.2 Billion.

And there’s much more to come. Udemy is well over $1 Billion in valuation now, as is Degreed, iCims, Avature, PhenomPeople, and many others. Pluralsight was acquired by Vista Equity for $3.5 Billion, and then acquired CloudGuru for $2 Billion. Some of these private companies may stay private, but my guess is that several of them may file to go public before this business cycle is over.

Why High Valuations? Three Good Reasons.

Why are valuations so high? Three good reasons.

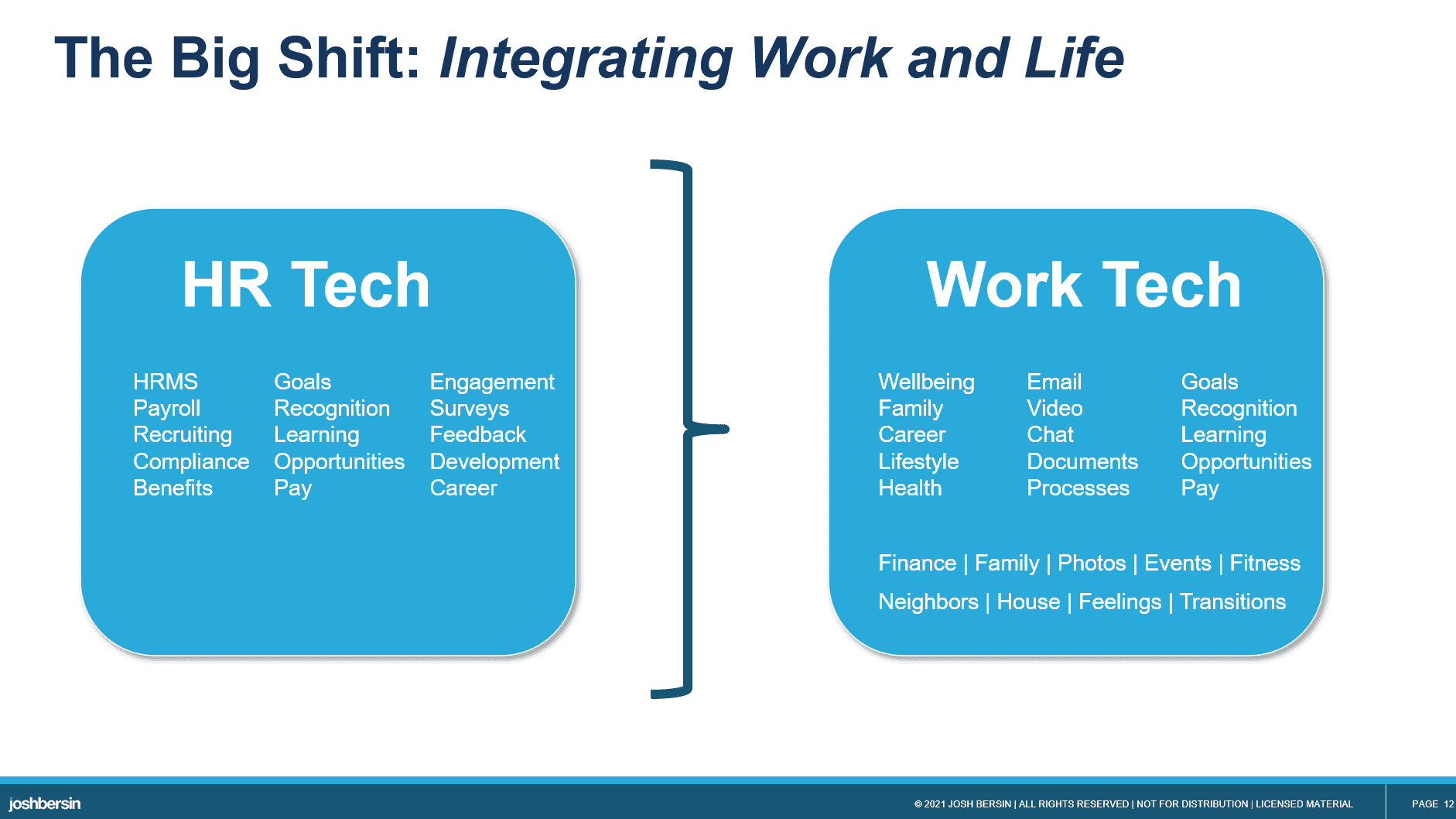

First, the HR Tech market is a healthy and sustainable growth market, with a new breed of vendors disrupting incumbents. With over 100 million businesses around the world and a fast-growing economy, everyone is arming up with HR Tech. Even during downturns, this market continues to grow, by the way. It’s a huge marketplace of continuous innovation, and we’re in a huge growth cycle now. And HR Tech and WorkTech are merging.

|

Second, there is a new breed of technology coming to market. Products like the ones above (and vendors like HiBob, Degreed, EdCast, Gloat, Fuel50, 360Learning, and others) are reinventing everything. Learning platforms are AI-powered, Skills-enabled, VR-ready, and they’re becoming Creator Platforms. Talent Marketplace systems are becoming integrated employee experience systems. And HR and Payroll platforms are becoming management tools and end-to-end hybrid work management systems.

The third reason, of course, is that interest rates are low so investors are willing to pay. This is not a risky market like Bitcoin or SpaceTech – these are good companies with solid business potential, selling to customers who see great value in their products. And since most are cloud platforms, recurring revenues grow at a compounded rate.

If you want to learn more about all this stuff, read my 2021 HR Technology: The Definitive Guide Market report, or come to the HR Technology Conference this Fall. Yes, I’ll be there in person and look forward to sharing more.

(By the way, White Hot refers to temperature.)

Additional Resources

HR Technology 2021: The Definitive Guide

A New Category Emerges: Creator Platforms For Corporate Learning

Talent Marketplace Platforms Explode Into View

The LXP Market: Now Too Big To Ignore

HR Technology 2021: Now Available On Kindle