Whats Going On At Skillsoft?

Skillsoft, one of the largest training companies in the world, is like a cat with nine lives. And this week it went public, for the second or third time.

What? Let me try to explain.

In the early days of e-learning (circa 2000), Skillsoft was the first online learning company focused on softskills. Hence the name. It was an innovative time and companies like Skillsoft, NetG, DigitalThink, and others defined the online learning market.

Skillsoft, which was run by a very strong team of sales leaders, outgrew most of the competition and started buying companies. And over time they acquired NetG, Books24x7, ElementK, MindLeaders, Vodeclic, SumTotal (one of the largest LMS companies), and most recently Global Knowledge. (I left out some smaller content companies.)

Along the way the company grew exponentially (sales teams all over the world) and the company went public, then later was acquired, and then took on debt, and was then recapitalized and is now public again. (There were a few other financial backflips along the way.) The original management team has all retired (a few like John Ambrose are still doing great things), and a whole new team came in. And these guys are ready to grow.

The company now boasts the largest library of content in the world (more than 10,000 titles, 40,000 books, and thousands of certification programs), a highly refined and modern learning platform (Percipio), and a very deep expertise in technical and professional training, compliance training, industry training, and many forms of credential, certification, badging, and compliance.

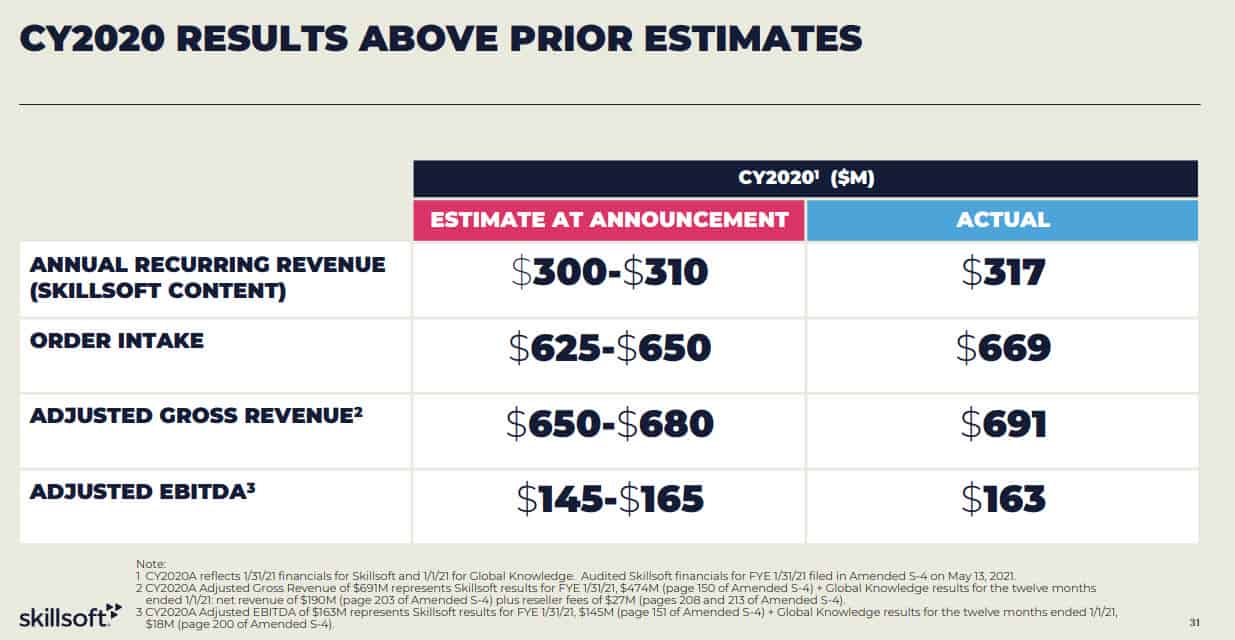

Today, now that the company is public again, you can see that the company generates near $700 Million in revenue (which makes it the #1 corporate online learning provider) and generates almost 35% in net income. The new management team, led by Jeffrey Tarr, has created a financial powerhouse that generates lots of cash for acquisitions. So you can expect Skillsoft to buy up a lot more companies.

|

(All you smaller content companies, you may want to get friendly with Skillsoft.)

As I explained recently, this puts Skillsoft on a growth trajectory as well. So for those of you looking for a large library of online learning for your company, Skillsoft can be a good bet.

|

Some of the statistics are pretty impressive:

- The corporate online learning market is roughly $10B in size and highly fragmented, and only about 25% fully penetrated by packaged providers (much is custom).

- Skillsoft has 180,000 courses and content objects, in a wide variety of formats (recently redesigned completely, 35% in the last year).

- The company offers branded content from MIT (Sloan), Mayo Clinic (health), and almost every leadership topic you can imagine.

- Skillsoft’s new Aspire Journeys are the equivalent of credentialed learning journeys and the company is building them in every professional domain.

- Percipio is now a highly competitive platform with features competitive with Degreed, EdCast, LinkedIn LearningHub.

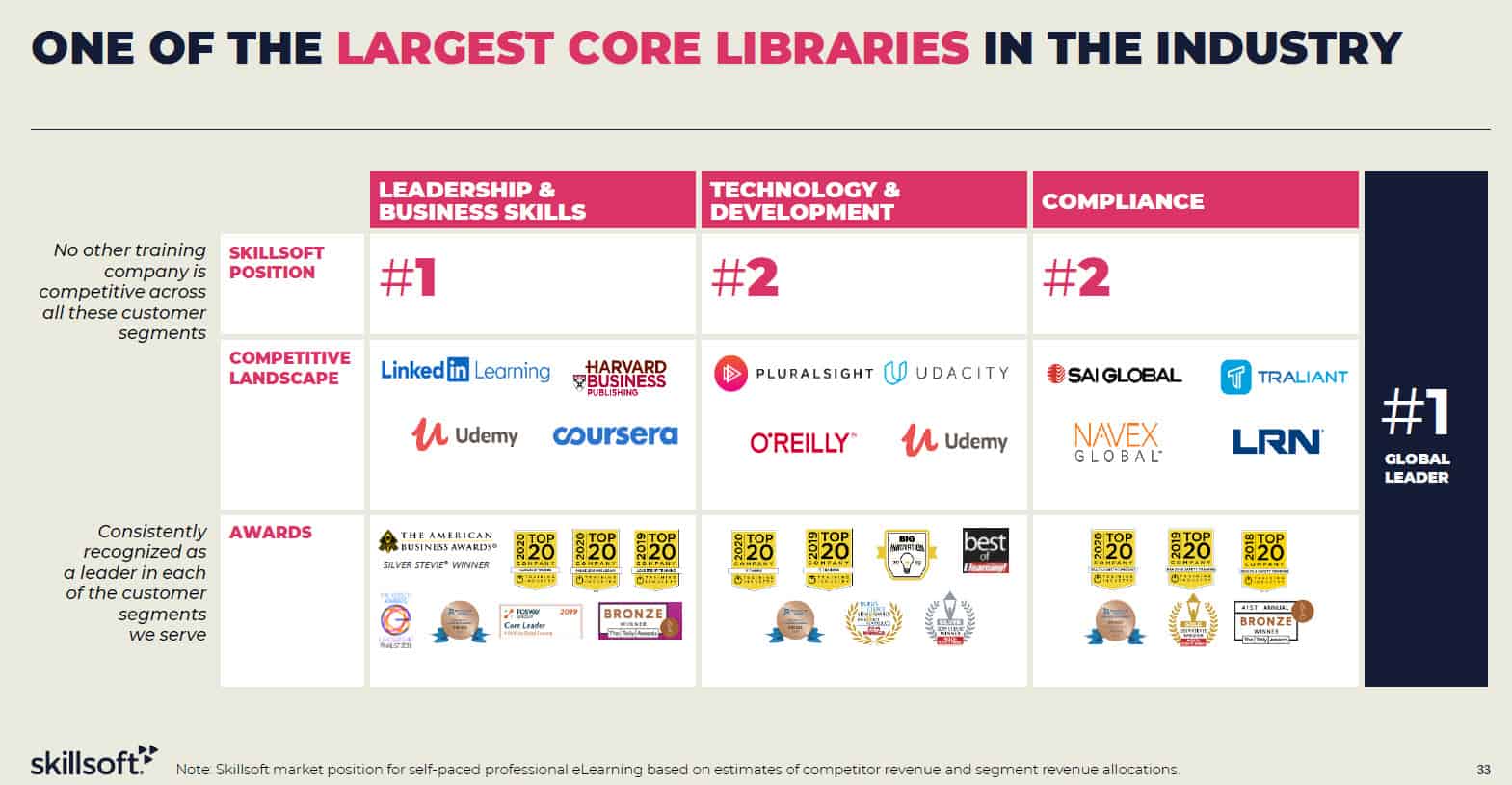

Of course, the content market has not been standing still. Hypergrowth companies like Udemy, Coursera, Pluralsight, LinkedIn Learning, Harvard Publishing, and hundreds of smaller vendors in every domain (including Cornerstone) compete with Skillsoft. And new formats like VR (Strivr, for example) now offer what I call “Extraordinary Experiences” in learning and are growing at triple-digit rates.

But now that Skillsoft has its financial ship in healthy shape, the company can innovate and grow again so we should expect much more to come. And that includes acquisitions, new content areas, and lots of new platform features.

I’ll be following Skillsoft closely in the months ahead: this is a company with ambition, a new brand, and a completely refreshed technology base. If you’re a global company with lots of training needs, I think you’ll find Skillsoft worth a good look.